Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Regulatory Digest

July 20, 2023Mid Year Regulatory Wrap 2023: Developments in Foreign Portfolio Investor Regime

INTRODUCTION

The first half of 2023 was full of action for Foreign Portfolio Investors (“FPIs”). The Indian securities market regulator, Securities and Exchange Board of India (“SEBI”) seemed to be on its toes, taking numerous measures to strengthen the regulation and governance of FPIs, and increase transparency in the system. The FPI regime witnessed multiple regulatory developments, including streamlining of the FPI onboarding process, amendment to the beneficial ownership thresholds, changes in timelines of reporting of material changes to SEBI / Designated Depository Participant (“DDP”), identification of legal entities of FPIs and introduction of the consultation paper to address concentrated group investments by FPIs, potential circumvention of certain regulatory and governmental prescriptions.

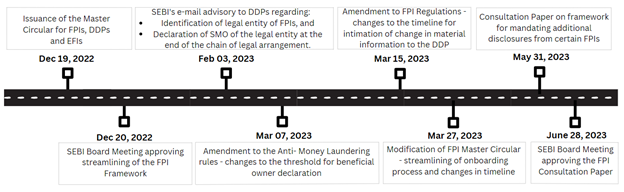

Figure: Timeline of the updates in the FPI regime

MASTER CIRCULAR FOR FPIS, DDPS AND EFIS

The SEBI (Foreign Portfolio Investors) Regulations, 2019 (“FPI Regulations”) governs FPIs investing in India. It outlines the eligibility criteria, categories of FPIs, investment conditions and restrictions, general reporting obligations, and other guidelines for FPIs and DDPs.

Along with the release of the FPI Regulations, SEBI had also issued the consolidated operational guidelines (“Operational Guidelines”) for FPIs, DDPs and Eligible Foreign Investors (“EFIs”) on November 05, 2019, in order to facilitate implementation of the FPI Regulations. Upon the introduction of the Operational Guidelines, the frequently asked questions (“FAQs”), erstwhile operating guidelines and other guidance, and the then existing circulars stipulated under Annexure A of the Operational Guidelines, were withdrawn by SEBI. Further guidelines pertaining to FPIs, DDPs and EFIs were issued by SEBI through subsequent circulars.

On December 19, 2022, the Master Circular for FPIs, DDPs and EFIs (“Master Circular”)1 was released by SEBI in supersession of the Operational Guidelines, consolidating various SEBI circulars and guidelines. Vide Annexure A of the Master Circular, SEBI had also rescinded few of its circulars.

The Master Circular serves as a comprehensive guide for FPIs, covering various aspects like the registration process of FPIs, know your customer (“KYC”)requirements, investment conditions / restrictions and avenues available to FPIs, conditions for issuance of offshore derivative instruments, position limits available for derivatives exposure by FPIs, investor charter for FPIs, etc.

STREAMLINING FPI FRAMEWORK: SEBI’S BOARD MEETING AND AMENDMENT TO MASTER CIRCULAR

In its board meeting held on December 20, 20222, SEBI, in order to facilitate ease of doing business and to reduce the time taken for registration for FPIs, approved the proposal of simplification of certain procedural requirements. Subsequently, the Master Circular was amended on March 27, 20233 to incorporate the following changes:

-

Grant of FPI registration on the basis of scanned copies of application forms and supporting documents;

-

Permission to use digital signatures by FPIs;

-

Certification of copies of original documents by authorized bank officials using SWIFT mechanism;

-

Verification of Permanent Account Number through the common application form module; and

-

Submission of unique investor group ID by FPI applicants in lieu of complete details of group constituents.

CHANGES IN THE THRESHOLD FOR IDENTIFYING BENEFICIAL OWNERS: AMENDMENT TO ANTI-MONEY LAUNDERING LAWS

On March 7, 2023, the Prevention of Money-laundering (Maintenance of Records) Rules, 2005 (“PML Rules”) were amended vide the Prevention of Money-laundering (Maintenance of Records) Amendment Rules, 2023(the “Amendment Rules”)4, which, inter alia, changed the threshold for identifying of beneficial owners (“BO”) of FPIs. The revised thresholds for identifying BOs are as below:

For Companies: Natural persons, acting alone or together, through one or more juridical person having controlling interest or exercising control through other means on the company. While controlling interest in this regard means ownership or entitlement to more than 10% of the shares or capital or profits of the company, control includes the right to appoint majority of the directors or to control the management or policy decisions including by virtue of the shareholding or management rights or shareholders agreements or voting agreements.

For Trusts: The author of the trust, the trustee, the beneficiaries with 10% or more interest in the trust and any other natural person exercising ultimate effective control over the trust through a chain of control or ownership.

Further, the Amendment Rules prescribe certain additional documents/ information to be furnished by entities for the purpose of due diligence.

Additionally, companies and partnership firms are required to provide the names of the senior management person/s and partners, respectively, along with the registered office address and the principal place of its business.

Trusts, on the other hand, have been mandated to disclose the names of their beneficiary/ies, trustee/s, settlor and author/s. Moreover, the Amendment Rules also stipulate the requirement of submission of the list of trustees, along with the documents for those individuals discharging the role as trustee and authorised to transact on behalf of the trustee. Further, the address of the registered office of the trust is also required to be disclosed.

It has also been prescribed that in case of any change in the already furnished data, such change would be required to be intimated by the client to the reporting entity within 30 days of such change.

SEBI (FOREIGN PORTFOLIO INVESTORS) (AMENDMENT) REGULATIONS, 2023

The December 20, 2022 board meeting of SEBI also approved amendments to be made in the FPI Regulations to provide clarity on certain timelines. Accordingly, the SEBI (Foreign Portfolio Investors) (Amendment) Regulations, 2023 (“Amendment Regulations”) were notified on March 15, 20235. The Amendment Regulations introduced certain significant changes to the FPI framework, as detailed below.

|

Sr. No. |

Events |

Regulation |

Amended Provision |

|

Application for FPI certificate |

|||

|

1 |

Application for grant of FPI certificate |

Regulation 3(2) |

In addition to the already existing provisions, the application is to be made in a manner specified by government and SEBI, along with the relevant documents specified by SEBI. |

|

General obligations and responsibilities of FPIs |

|||

|

2 |

Written update to SEBI and DDP upon finding that any information or particulars previously submitted are false or misleading in any material respect |

Regulation 22(1)(b) |

Revised Timeline As soon as possible but not later than 7 working days |

|

3 |

Written update to SEBI and DDP in case of any material change in the information previously furnished |

Regulation 22(1)(c) |

Factors included in material change –Direct or indirect change in the investor group has been included. Revised Timeline – As soon as possible but not later than 7 working days |

|

4 |

General obligation and responsibilities of FPI |

Regulation 22(1)(l) |

FPIs to ensure maintenance of accurate details of investor group with the DDP at all times. |

|

5 |

Notice to DDP |

Regulation 22(5) |

Requirement to update the DDP in case of any direct or indirect change in the investor group has been included. Timeline – As soon as possible but not later than 7 working days. |

|

General obligations and responsibilities of DDPs |

|||

|

6 |

Written update to SEBI upon finding that any information or particulars previously submitted are false or misleading in any material respect |

Regulation 31(1)(b) |

As soon as possible but not later than 2 working days |

|

7 |

Written update to SEBI for any material change in previously furnished information |

Regulation 31(1)(c) |

As soon as possible but not later than 2 working days |

|

8 |

Updating SEBI, depositories and stock exchanges of penalty, pending litigation or proceedings, findings of inspections or investigations for which action may have been taken or is in the process of being taken by any regulator against the DDP |

Regulation 31(1)(g) |

As soon as possible but not later than 2 working days |

SEBI’S E-MAIL TO DDPS FOR IDENTIFYING LEGAL ENTITIES OF FPIS

SEBI vide an e-mail communication to DDPs dated February 03, 2023 (“E-mail”) communicated certain client identification, KYC and beneficial ownership requirements for FPIs.

The E-mail stipulated that only a legal entity could become a client of DDP in its capacity of a reporting entity under the Prevention of Money-Laundering Act, 2002 (“PMLA”). Therefore, a bank and not its branch which may be registered as an FPI with SEBI, or an entity and not its sub-funds investing in India as FPIs, should be the client of the DDPs. However, such legal entities should be able to obtain multiple FPI registrations in the name of their funds / sub-funds.

Additionally, SEBI directed DDPs to identify and declare, if required, the senior managing official of the legal entity at the end of the chain of the legal arrangement, as the BO of the FPI. Further, SEBI also directed FPIs to re-identify and disclose the BO(s) in accordance with the Amendment Rules.

The E-mail instructed DDPs to fulfill the KYC requirements and update the BO data of the FPIs, if required, in their records as well as on the KYC Registration Agency portal by September 30, 2023. Failure to comply with this requirement by FPIs would result in prohibition of making fresh purchases and necessitate the liquidation of their holdings. Furthermore, such non-compliant FPIs would have to surrender their FPI registration by March 31, 2024.

CONSULTATION PAPER ON FRAMEWORK FOR MANDATING ADDITIONAL DISCLOSURES FROM FPIS

On May 31, 2023, SEBI released a consultation paper for FPIs6 outlining a framework for mandating additional disclosures from certain FPIs (“Consultation Paper”). The Consultation Paper aims to mandate additional disclosures from FPIs that meet specific objective criteria, to guard against possible (a) circumvention of minimum public shareholding (“MPS”) rules, and (b) misuse of the FPI route to circumvent the requirements of Press Note 3 (“PN3”)7.

Proposals

Identification of all holders of ownership, economic, and control rights for high-risk FPIs on a look through basis

SEBI has proposed enhanced transparency measures for identifying all holders of ownership, economic, and control rights of high-risk FPIs which fulfil certain criteria (please refer to the below table for the proposed categories of FPIs).

The above identification has been proposed to be done on a look-through basis down to the level of natural persons, public retail funds, or large listed corporates, without applying any materiality thresholds, and notwithstanding any equivalent PMLA rules or secrecy laws that may be applicable in the FPI’s domicile jurisdiction.

Categories of FPIs on a Risk-Based Criteria

|

Low Risk FPIs |

Moderate Risk FPIs |

High Risk FPIs |

|

Government and Government related entities such as central banks, sovereign wealth funds, etc. |

Pension funds or public retail funds8 with widespread and dispersed investors in such funds. |

All other FPIs that are not low or medium risk. |

|

These entities whose ownership, economic and control interest in is known due to predominant ownership by the Government of the respective country. |

Such categorization shall be subject to the ability of DDPs to independently validate and confirm the status of such FPIs as mentioned above. |

SEBI, in its board meeting held on June 28, 2023 has approved the Consultation Paper. Interestingly, it has expanded the list of entities that are exempt from making additional disclosures to, inter alia, include corporate entities and verified pooled investment vehicles meeting certain conditions.

CONCLUSION

With more and more FPIs investing in the Indian listed market and the furore caused by the Hindenburg Research Report dated January 24, 2023, SEBI’s vigilance is bound to increase. Though these measures should make the system more transparent in the long run, such frequent changes with no clear directions at times may upset the FPIs. A clear balance between maintaining transparency in the system and not unduly inconveniencing the FPIs should be the ideal way forward.

– Ritul Sarraf, Prakhar Dua & Kishore Joshi

You can direct your queries or comments to the authors.

2PR No. 37/2022, available at https://www.sebi.g ov.in/medi a/press-r eleases/d ec-2022/s ebi-board -meeting_ 66407.html

3Circular No. SEBI/HO/AFD/P/CIR/2023/043 dated March 27, 2023, Available at https://www.sebi .gov.in/legal/c irculars/mar-20 23/streamlining -the-onboarding -process-of-fpi s_69390.html

4https://egazette .gov.in/W riteRead Data/202 3/244194 .pdf

5https://egazett e.gov.in /WriteR eadData/ 2023/24 4410.pdf

7Available at https://dpii t.gov.in/si tes/defaul t/files/p n3_2020.pdf. On April 17, 2020, the Government of India issued PN3 (2020 Series) to limit ‘opportunistic’ foreign direct investments from countries sharing land border with India. The PN3 mandated that where an investing entity is situated in a country sharing land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country, FDI shall be permitted only with prior Government approval.

8The Explanation to Regulation 22 (4) of the FPI Regulations define ‘Public Retail Funds’ as mutual funds or unit trusts which are open for subscription to retail investors and which do not have specific investor type requirements like accredited investors; insurance companies where segregated portfolio with one to one correlation with a single investor is not maintained; and pension funds.