Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Tax Hotline

March 4, 2009Software Taxation: AAR refuses to entertain Microsoft's application

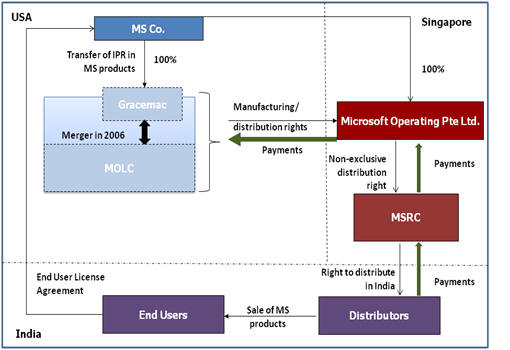

Section 245R(2) of the Indian Income Tax Act, 1961 (‘ITA’) provides for situation wherein application filed before the Authority for Advance Ruling (“AAR”) may be rejected at the stage of admission. The matter of Microsoft Operations Pte. Ltd., Singapore (the “Applicant”), a wholly owned subsidiary of Microsoft Corporation US (“MS Co.”) is one such instance.

FACTS

Gracemac Corporation (“Gracemac”), a wholly owned subsidiary of MS Co., had been granted the proprietary and ownership rights with respect to licensing and IPR of Microsoft products in Asia by MS Co., with effect from 1.1.1999. Gracemac had further entered into a license agreement with the Applicant whereby the Applicant was granted, for a consideration as provided in the agreement, a non-exclusive license to manufacture, reproduce and distribute Microsoft products in Asia including India. For the purposes of distribution of the software, the Applicant appointed Microsoft Regional Sales Corporation (“MRSC”), which in turn entered into agreements with third party distributors for the sale of the Microsoft products in India.

In the year 2006, Gracemac merged with MOL Corporation (“MOLC”); after which the Applicant entered into a fresh license agreement on similar terms with MOLC.

The Applicant approached the AAR to adjudicate upon whether the payments received by MOLC from the Applicant under the license agreement as well as those received by MRSC from the Indian distributors be characterized as ‘royalty income’ under the ITA and/or the India-US tax treaty and hence accordingly, whether tax is required to be withheld by the Applicant.

ADMISSIBLITY OF THE APPLICATION: CONTENTIONS BEFORE THE AAR

The primary contention of the Revenue was with respect to the non-maintainability of the present application, on grounds that the Applicant had an appeal pending before the Income Tax Appellate Tribunal, Delhi (“Tribunal”). The Revenue based its contention on Section 245-R(2) of ITA, whereby the AAR is granted wide discretion to accept an application, except in certain circumstances, which includes a situation where the question raised before the AAR is pending for adjudication before any tax authority or Tribunal and accordingly claimed that the aforesaid section clearly prevented the AAR from adjudicating on the merits of the application at hand.

It is important to note that for the assessment years 1999-2000 to 2005-06, the Tribunal had held, after analyzing inter-alia agreements (similar to those referred to in the present application) entered into by Gracemac with MS Co., Applicant and the end-users, that the license fee received was in the nature of royalty income and thus, liable to be taxed in India.

The Applicant had counterclaimed that the appeals at the Tribunal were Gracemac’s appeals; however, this application was filed with respect to the agreement with MOLC and thus, no proceedings in relation to the Applicant in respect of the same transaction can be said to be pending. The Applicant further contended that proceedings at the AAR with regard to withholding of taxes cannot be equated to proceedings at the Tribunal with respect to determination of Gracemac’s liability to pay taxes in India.

RULING

The AAR rejected the contentions of the Applicant and thereby the application made by the Applicant on the ground that the matter in question was ‘already pending’ before the Tribunal. The AAR noted that as a result of merger with MOLC, MOLC itself becomes the appellant in the pending appeals and that the obligation of the Applicant to withhold the tax at source cannot be decided de hors the issues raised concerning the tax liability of MOLC.

Further, the AAR noted that if the Tribunal and the AAR rule differently, it would give rise to an anomalous situation and having allowed the proceedings thus far, the Applicant cannot as a matter of right seek the ruling from the AAR. The AAR also referred to the ruling delivered in the case of Airports Authority of India, wherein the application was allowed even though it concerned tax withholding obligations and appeals against assessment orders were still pending. The AAR distinguished the facts of the Airports Authority case by pointing out that in that case the assessing officer had created uncertainty by departing from AAR’s earlier ruling on the same subject matter and further, the AAR was approached by the aggrieved applicant at the earliest opportunity. However, in the present case, the Applicant had taken its chances at the time of the assessment and the first appellate proceedings and thereafter approached the AAR. Thus, the applicant had no grounds to pursue the AAR to exercise its discretion and adjudicate upon the questions raised.

ANALYSIS

This ruling sends out a clear message that notwithstanding the discretion conferred on the AAR, it is not open to the AAR to ignore the legal bar created by the proviso to Section 245R(2)of the ITA. Further, it is evident that AAR restrains from exercising its discretionary powers to admit applications wherein the applicant has tried to make out its case at various levels and thereafter, on receiving an adverse order from all counters, approach the AAR. The sanctity of the process for advance ruling is required to be respected and strictly adhered to.

It may be recollected that as per various media reports in the recent past, tax authorities have alleged that Gracemac is liable to pay income tax on its gross royalty income earned out of licensing of software to Indian customers and had alleged that payments made for use of shrink wrap software are royalty income. Pertinently, the AAR did not discuss the case on merits and therefore, the question with respect to payments in lieu of software still remains to be decided by the Tribunal.

- Neha Sinha, Mansi Seth & Parul Jain

You can direct your queries or comments to the authors