Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Tax Hotline

February 13, 2009Taxation of Mauritius cell companies examined

Over the years, different entities have been used by fund managers as investment vehicles. To suit the preferences of investors, commonly used jurisdictions had developed innovative models of these entities. One such instance is the use of a company with different share classes where each class represents a separate fund with distinct investment objectives. This “multi-class umbrella fund” is particularly useful where a fund manager desires to manage the assets of multiple funds and, at the same time, market the multiple funds as a single opportunity. Although the “multi-class umbrella fund” has its commercial benefits, it does not provide for segregation of liabilities between the share classes / sub-funds, which is a major concern among investors. To address this issue of cross-class liability, several investor friendly jurisdictions, including Mauritius, introduced the concept of a Protected Cell Company (“PCC”). A PCC is statutorily authorized to segregate its assets into cells and a creditor of one cell can only proceed against the assets of that cell, a concept known as “ring-fencing”. Over the last decade, PCCs have evolved as the most popular entity for use as collective investment vehicles across jurisdictions particularly Europe.

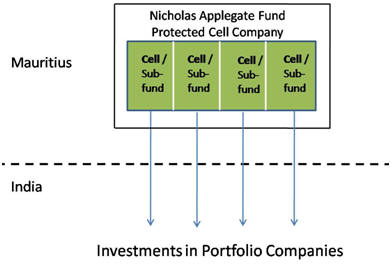

TAX TREATMENT OF PROTECTED CELL COMPANIES: THE NICHOLAS APPLEGATE RULINGAlthough in law the cells of a PCC are separate from each other, the same principle is usually not applied in the case of taxation. Most jurisdictions which have cell company legislation regard the PCC as a single taxable person and each cell is not liable to tax separately, a position that also arises from the fact that the cells of a PCC are not separate legal entities. However, with regard to jurisdictions that do not have cell company legislation such as India, it is somewhat unclear as to whether the same principle will be followed or if each cell will constitute a separate taxable entity. Recently1, a fund incorporated under the Mauritius Protected Cell Company Act was faced with the same puzzling question in respect of the taxation of its investments in India.

-

Nicholas Applegate South East Asia Fund (“Fund”), a Mauritius PCC, had four cells where each cell represented a separate fund (“Sub-fund”). The Fund and each Sub-fund had separate Permanent Account Numbers2 and each Sub-fund had a separate sub-account registration under the Securities and Exchanges Board of India (Foreign Institutional Investor Regulations), 1995. The Sub-funds had incurred short term capital losses in respect of its Indian investments and intended to carry forward these losses to the following year as per the provisions of section 74 of the Indian Income Tax Act,1961 (“ITA”).

- On account of the uncertainty regarding the tax treatment under the ITA of cell companies, a separate tax return (“Initial Return”) for each Sub-fund was filed assuming that this was the requirement under the ITA. However, realizing that a single consolidated return may be what is actually required under the ITA, the same was later filed by the Fund (“Revised Return”).

- In order to be eligible to set off losses incurred during the year against future profits, the Fund was required under the ITA to furnish the return before a certain period. The Initial Return was filed within the prescribed time and the Revised Return was filed sometime later. The Assessing Officer (“AO”) held that the Initial Return was “invalid” since the cells of the PCC were not liable to tax separately and accordingly considered the Revised Return as the Initial Return. Since the Revised Return had been filed after the due date, the Fund was not allowed to carry forward the loss. The first appellate authority rejected the Fund’s appeal and the second appeal was made to the Income Tax Appellate Tribunal (“Tribunal”).

- The Tribunal held that the Initial Return was valid in so far as it fell within the ambit of section 292B. As per section 292B, a return which suffers from a defect, mistake or omission is not invalid if it is otherwise, in substance and effect, in conformity with the purpose of the Act. Thus, according to the Tribunal, the filing of separate returns in respect of each Sub-fund was a technical mistake which stood removed on the filing of the consolidated return and the Initial Return being valid and within the prescribed time, the Fund was permitted to set off losses incurred during the year against future profits.

We believe that although the Tribunal did not directly address the issue of whether each cell of the PCC is a separate taxable entity, the very fact that it regarded the Initial Return as defective seems to indicate that individual cells of a PCC will not constitute a separate taxable entity. The position is further strengthened by a plain reading of section 2 (31) of the ITA which identifies only the company and does not refer to the cells of a company as a (taxable) person for the purposes of the ITA.

Thus we may infer that a PCC, regardless of its jurisdiction of incorporation, will be liable to tax in India as a single taxable person, as opposed to each cell being liable to tax separately. An apparent benefit of this treatment is that losses of a cell will offset the profits of another, thereby reducing taxable income, which would not have been the case if the cells were treated as separate taxable entities. In light of the view taken by the Tribunal, it would be interesting to evaluate the tax treatment in India of an Incorporated Cell Company, which is a further enhancement of the PCC. In an Incorporated Cell Company each cell is a separate legal entity and taxed separately in its home jurisdiction. In such a case would the Indian tax authorities regard each cell as a separate “person” liable to tax? It is a question which remains to be answered.

- Mihir Shedde & Bijal Ajinkya

You can direct your queries or comments to the authors

1 Nicholas Applegate South East Asia Fund Ltd. v. ADIT [2009-TIOL-74-ITAT-MUM-TM]

2 Permanent Account Number or PAN is the tax identification number issued by the tax authorities