Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Insolvency and Bankruptcy Hotline

January 12, 20232022 Year End Wrap - Insolvency and Bankruptcy Code, 2016 – Part 1

Introduction

With the passage of almost six years since the introduction of the Insolvency and Bankruptcy Code, 2016 (“IBC/Code”), the Code has achieved substantial progress towards providing a robust insolvency resolution mechanism in the country. At the same time, we have also witnessed significant challenges in the effective implementation of the Code.

We have prepared a two-part year end wrap for 2022 which provides a brief overview on the progress of the insolvency resolution regime. In part 1 we have analysed some of the empirical data on recoveries and investments under the Code as well as impact of legislative/regulatory amendments on investments and acquisitions under the Code. In part 2 we have analysed some of the significant judicial pronouncements and their impact on the investor community as well as other stakeholders.

Empirical Data of Realization by Creditors

Scheduled Commercial Banks (“Banks”) form the largest category of creditors by value in the lender ecosystem of India. The RBI releases an annual report titled ‘Report on Trend and Progress of Banking in India’ which provides data on recoveries made by Banks through various routes. The recoveries made by Banks form a major component of the total recoveries made by all creditors under the IBC route. Therefore, we have used this data to analyse the changing rate of recovery under the IBC route in the past five financial years.

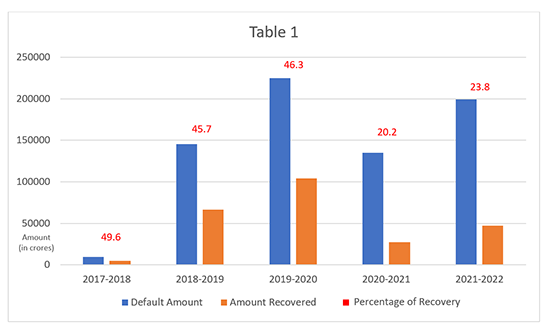

The quantum of recovery by Banks under the IBC has been encouraging in the formative years followed by some stagnation. The below graph provides the statistics of total claim amounts undergoing insolvency resolution and the corresponding recovery in the past five financial years.1 The graph also includes the percentage of realization of amounts by the Banks for each financial year.

The percentage of recovery appears to have reduced in the last two financial years. We understand that the same should be owed to the slowdown brought by the Covid-19 pandemic during which (a) the Code was suspended, and (b) National Company Law Tribunals (NCLTs) were functioning with limited infrastructure to support handling of the case load virtually. As a result, the insolvency framework was practically stalled during most parts of F.Y. 2020 - 2021.

It is seen from Table I that the claim amounts submitted by Banks for insolvency resolution under the IBC route increased substantially before the Covid disruption. Therefore, it is apparent that Banks were choosing IBC as the preferred route for realization of their dues. Post the Covid disruption, due to increasing backlog of cases, there were huge delays in successful completion of Corporate Insolvency Resolution Processes (“CIRP”) through approval of resolution plans. As a result, we saw an abrupt dip in the percentage of recovery for creditors in the F.Y. 2020 - 2021 and 2021 - 2022.

Further, till September 2022, 23,417 applications for initiation of CIRPs, having underlying default of INR 7.31 lakh crore were resolved before their admission.2 This augur to the fact that a substantial number of debtors are settling their outstanding dues before the commencement of CIRP. In the absence of a ‘pre-packaged insolvency framework’ for all debtors,3 promoters of defaulting debtors were agreeing to a settlement arrangement akin to a resolution plan without the requirement to commence a CIRP.

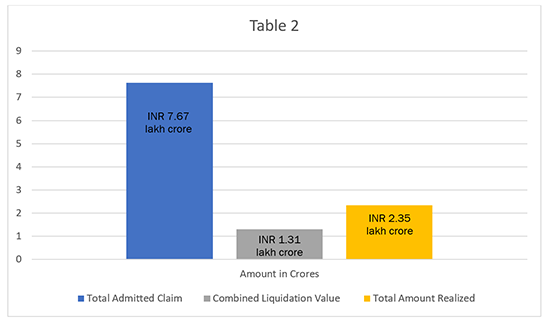

Since the inception of the IBC, a total of 5,636 applications seeking initiation of a CIRP have been admitted, out of which 517 have been successfully concluded after the approval of resolution plans by NCLT.4

From a combined reading of Table I and Table II, we understand that the consolidated recovery made by creditors since the inception of the Code has been approximately 30% of the total admitted claim. Further, the percentage of recovery against the claim amounts has dropped to 23% in F.Y. 2021 - 2022. However, creditors have been able to recover 178% of the combined liquidation value of all the defaulting debtors.

This implies that the IBC route has definitely benefited creditors in improving their recovery rates as compared to the erstwhile regimes of SARFAESI, RDDBFI and winding up under Companies Act. However, there is a substantial scope for improvement of recovery rates to ensure value maximization in a time bound manner. The percentage of recovery recorded prior to the Covid pandemic is a strong indicator of the benefits of an efficient and streamlined insolvency resolution regime.

Statutory and Regulatory Developments

-

Amendment to The CIRP Regulations, 2016

Recently, the IBBI notified the Insolvency Resolution Process for Corporate Persons (Fourth Amendment) Regulations, 2022 whereunder the following key amendments were made5:

-

Facilitating a compromise/arrangement

Section 230 of the Companies Act, 2013 provides for a compromise and arrangement between a company and its creditors. A liquidator appointed under the Code can file an application before the NCLT, seeking a meeting of creditors under Section 230 of the Companies Act, 2013, for a compromise or arrangement. The ‘IBBI Discussion Paper on Streamlining the Liquidation Process’ stated that all liquidation processes closed in the aforesaid manner took an average 466 days for completion. A major chunk of this time is taken by the NCLT in disposing the application filed by the liquidator.

To mitigate such delays, Regulation 39BA has been added to the Code pursuant to which the ‘Committee of Creditors’ (“COC”) shall explore the possibility of a compromise or arrangement while deciding to liquidate the corporate debtor. If the COC proposes a compromise or arrangement, the resolution professional shall present such recommendation to the NCLT when the application seeking initiation of liquidation is filed with the NCLT. Thereafter, the resolution professional and the COC shall keep exploring the possibility of compromise or arrangement during the period the liquidation application is pending determination before the NCLT. This will ensure that if a compromise or arrangement can be achieved, the same does not suffer from unnecessary delays due to procedural requirements.

-

Issuance of a request for the Resolution Plan

Newly inserted Regulation 36(B)(6(A)) provides that a resolution professional may issue a ‘second request for submission of resolution plan’ for sale of assets of the corporate debtor. This provision can be availed in a situation where no resolution plans have been received under the first invitation.

The underlying purpose for the said amendment appears to be towards curtailing delays in completion of CIRPs. Earlier, there was no guidance on the number of times a resolution professional could restart the process of “invitation for submission of resolution plans”. Therefore, either due to instructions by the COC or directions passed by the adjudicatory authorities, every CIRP would have multiple rounds where the public would be invited to submit resolution plans. The present amendment attempts to remedy this malaise by putting a cap on the number of times this process can be conducted, thereby making the entire CIRP more streamlined and time bound.

-

Enabling marketing of assets of the Corporate Debtor

Newly inserted Regulation 36C provides that where the total value of assets of the corporate debtor exceeds INR one hundred crores, the resolution professional shall prepare a strategy for marketing of assets of the debtor. The implementation of such strategy is subject to the approval of the CoC.

The general methods adopted by a RP to disseminate information would be to publish advertisements in newspapers and a press release on the website of the corporate debtor. Considering that there are strict timelines for submission of resolution plans from the date of publication of the invitation to do so, there is considerable lack of awareness amongst the investor community about such processes. If a RP receives lesser number or inferior quality of resolution plans, the debtor is likely to be forced into liquidation. Therefore, marketing of the assets of the debtor is necessary and constitutes a step towards the right direction in maximizing the value of assets of the debtor in a time bound manner.

-

Submission of the information memorandum

The amendment to Regulation 36(1) provides for a revision in the timelines for submission of the Information Memorandum (IM) by the RP. Under the amended Regulation 36(1), the RP must submit the IM to the CoC on or before the ninety-fifth day from the insolvency commencement date. Regulation 36(2) was also amended to expand the scope of the mandatory contents of an IM. An IM is now required to include ‘key selling propositions’ and ‘all relevant information which shows significant information about the corporate debtor’ (including its operations and financial statements). An IM should also include all ‘contingent liabilities’ of the debtor, ‘geographical coordinates’ of all fixed assets; and details of business performance, key contracts, key investment and other factors along with brought forward income tax losses, input credit of GST, key employees, key customers, supply chain linkages, utility connections and other pre-existing facilities.

The IM which is akin to a consolidated statement of assets and liabilities of the debtor is prepared by the RP for the benefit of the COC as well as prospective resolution applicants. The IM is a key tool that ensures appropriate marketing of the true value of the assets of the debtor as well as fair disclosure of information towards securing the interest of the investor-acquirer. A comprehensive and robust IM is likely to infuse more confidence amongst investors interested in acquiring stressed assets under the IBC.

-

-

Amendment to IBBI (Liquidation) Regulations, 2016

-

Constitution of the Stakeholder Consultation Committee

The IBBI (Liquidation Process) (Second Amendment) Regulations, 20226 (“Liquidation Amendment Regulations”) amended Regulation 31A of the IBBI (Liquidation) Regulations, 2016(“Liquidation Regulations”) to provide that the first meeting of the Stakeholder Consultation Committee(SCC) is to be held within 7 (seven) days of the liquidation commencement date.7 However, the existing Regulation 31A(1) of the Liquidation Regulations provides that the liquidator should constitute the SCC within 60 (sixty) days from the liquidation commencement date. Therefore, there might be an inadvertent anomaly in the timeline for constitution of the SCC and its first meeting.

-

Replacement of the liquidator

The newly inserted Regulation 31A(11) of the Liquidation Regulations provides that the SCC, by a minimum vote of 66% of the committee members may propose the replacement of the liquidator. The amendment provides for the SCC to file an application before the NCLT for replacement of the liquidator.

With the above amendment, statutory/regulatory power has been conferred on the SCC to replace the liquidator in the event that the liquidator is failing to discharge its statutory duties. Historically the timeline for completion of sale of stressed assets through public auction has been plagued by inordinate delays. However, the present process of liquidation under the Code requires a swift completion of sale and dissolution of the stressed entity, therefore it is important for the liquidator to be proactive and accountable to the SCC.

-

– Adimesh Lochan & Arjun Gupta

You can direct your queries or comments to the authors

1 See Reports at

(a) 2017 - 2018 at

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP2018_FE9E97E7AF7024A4B94321734CD76DD4F.PDF.

(b) 2018 - 2019 at

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP241219FL760D9F69321B47988DE44D68D9217A7E.PDF.

(c) 2019 - 2020 at

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP2020_F3D078985540A4179B62B7734C7B445C9.PDF.

(d) 2020 - 2021 at

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP2020CF9C9E7D1DE44B1686906D7E3EF36F13.PDF. and

(e) 2021 - 2022 at

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP20212225730A6FC708454BB270AC1705CCF178.PDF.

2 IBBI Quarterly Report July – September 2022, available at

https://ibbi.gov.in/uploads/publication/f3ddc90d7391bcae84ef2f87f793eb3c.pdf.

3 Currently, the Pre-packaged insolvency framework is only applicable for Micro, Small and Medium Enterprises.

4 IBC – Ideas, Impressions and Implementations, 2022

https://ibbi.gov.in/uploads/whatsnew/b5fba368fbd5c5817333f95fbb0d48bb.pdf.

5 No. IBBI/2022-23/GN/REG093 – Notification dated September 16, 2022.

6 No. IBBI/2022-23/GN/REG094 – By IBBI Notification dated September 16, 2022.

7 Amended Regulation 31A(6), Liquidation Regulations.