Tax HotlineMarch 20, 2017 Retrospective Capital Gains Tax On Indirect Transfers: The Ghost of the Vodafone Case Revisits Cairn (UK)

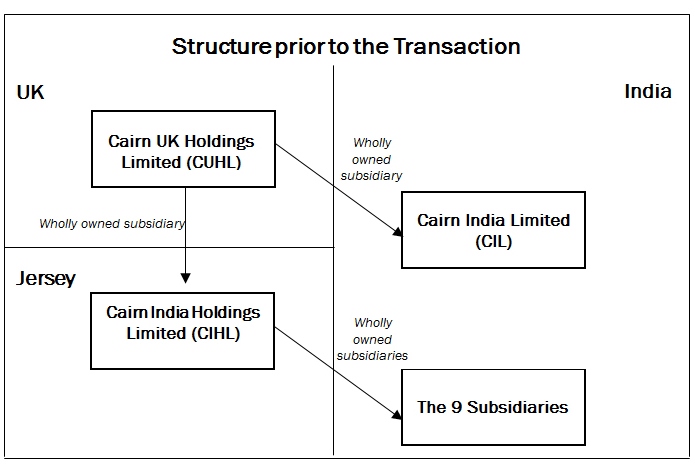

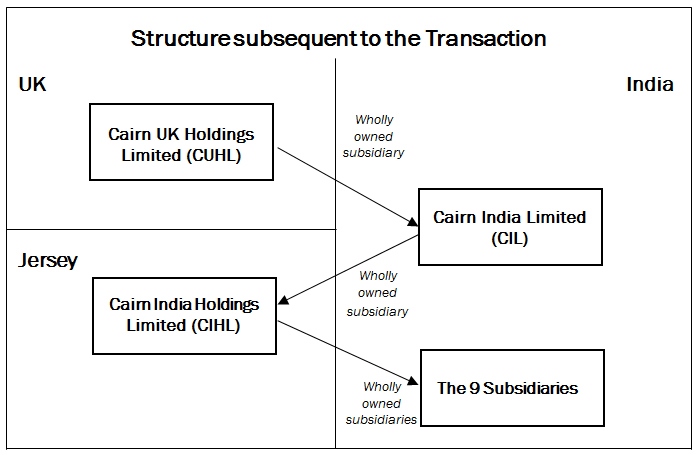

BACKGROUND Explanations 4 and 5 to Section 9(1)(i) of the Income-tax Act, 1961 (“Indirect Transfer Provisions”) were introduced by way of the Finance Act, 2012 pursuant to the landmark ruling of the Supreme Court in Vodafone International Holdings BV v. Union of India1 (the “Vodafone case”) in which the Court held that transfer of shares of a Cayman Islands company would not be subject to capital gains tax in India, since the shares of the Cayman Islands company were not located in India. The Indirect Transfer Provisions were enacted with retrospective effect from 01/04/1962 and were styled as a clarification. Over the past few months, the Central Board of Direct Taxes (“CBDT”) has taken a number of steps to ease concerns relating to this issue. In June, 2016 CBDT amended the Income-tax Rules, 1962 to provide for computation and fair market value and reporting requirements in relation to the Indirect Transfer Provisions.2 However, the Indirect Transfer Provisions continue to be applied in a harsh manner, which provides cause for grave concern and uncertainty. FACTSCairn India Holdings Limited (“CIHL”) was incorporated in Jersey in August, 2006 as a wholly owned subsidiary of Cairn UK Holdings Limited (“CUHL” / “Taxpayer”), a holding company incorporated in the United Kingdom in June, 2006. Under a share exchange agreement between CUHL and CIHL, the former transferred shares constituting the entire issued share capital of nine subsidiaries of the Cairn group, held directly and indirectly by CUHL, that were engaged in the oil and gas sector in India (“Subsidiaries”). Thereafter, Cairn India Limited (“CIL”) was incorporated in India in August, 2006 as a wholly owned subsidiary of CUHL. By way of a subscription and share purchase agreement and a share purchase deed, shares constituting the entire issued share capital of CIHL were transferred to CIL (“Transaction”), the consideration for which was partly in cash and partly in the form of shares of CIL. CIL then divested 30.5% of its shareholding by way of an Initial Public Offering (“IPO”). As a result of divesting Approx. 30% of its stake in the Subsidiaries and part of IPO proceeds, CUHL received Approx. INR 6101 Crore (Approx. USD 931 Million).

In January, 2014, many years after the transaction was completed as per the existing law, the Assessing Officer (“AO”) initiated reassessment proceedings under Sections 147 and 148 of the Income-tax Act, 1961 (“ITA”) which provide for reassessment proceedings in cases where income has escaped assessment. The AO issued the draft assessment order in March, 2015, to which CUHL filed its objections before the Dispute Resolution Panel (“DRP”) under Section 144C of the ITA. The DRP issued its directions in December, 2015 and the AO drafted the final assessment order in January, 2016, determining the income of the Taxpayer arising from the Transaction at Approx. INR 24,500 Crore (Approx. USD 3.742 Billion) as short-term capital gains chargeable to tax at a 40% rate, subject to chargeability of surcharge and cess as applicable. As per the order, the taxpayer is also required to pay interest under Sections 234A and 234B of the ITA which provide for levy of interest in case of defaults in payment of taxes by a taxpayer, and penalty proceedings under the ITA were also initiated against the Taxpayer. Aggrieved by such order, the Taxpayer preferred an appeal before the Income Tax Appellate Tribunal, Delhi bench (“ITAT”). ARGUMENTS ADVANCEDThe Taxpayer made the following contentions:

The tax department put forth the following submissions:

The ITAT at the outset dismissed the Taxpayer’s argument regarding the legal validity of the retrospective amendments brought in by the Indirect Transfer Provisions, taking the view that the ITAT is not the appropriate forum to rule on the constitutional validity of the Indirect Transfer Provisions. On the Taxpayer’s contention thst a ‘static’ approach ought to be employed in interpreting the Tax Treaty so as to tax assessees as per domestic law as it existed in 1994, the ITAT perused the ruling of the Delhi High Court in the case of DIT v. New Skies Satellite BV3 which was relied on by the Taxpayer. The ITAT observed that acts of Parliament may neither supply or alter the boundaries of a tax treaty, nor supply any redundancy to any part of the tax treaty. The ITAT then drew an analogy and opined that similarly, the provisions of a tax treaty cannot limit the boundaries of domestic tax laws. It therefore endorsed the ambulatory approach / dynamic interpretation of tax treaties whereby the tax treaty will be interpreted in light of current law as it exists. The ITAT also took the view that the facts in the case at hand did not involve a simple internal reorganisation, since the entire series of transactions culminated in the IPO by way of which the Taxpayer received considerable gains. On perusing the financial statements of the Taxpayer the Court also observed that the Taxpayer had not paid any tax on the capital gains even in UK. Based on this and the view that tax treaties are intended to provide relief from double taxation, the ITAT held that the gains are chargeable to tax in India owing to the Indirect Transfer Provisions. The ITAT did afford the taxpayer a lone breath of relief by ruling that the Taxpayer could not have previously visualized its tax liability in 2006 at the time of the Transaction and relied on various judicial pronouncements to ultimately hold that the Taxpayer cannot be burdened with the levy of interest as contended by the tax department. However, moving to the last issue on the penalty proceedings under the ITA, the ITAT observed that the issue was premature and went on to dismiss that ground of the appeal. In conclusion, the appeal of the Taxpayer was partly allowed, as regards the issue of payment of interest. ANALYSISThe primary contention of the tax department which formed the bedrock for all other contentions raised by them, was that the income in question was always, and is taxable in India, since the shares of CIHL which were transferred by the Taxpayer derive their value substantially from assets situated in India, thus reemphasizing that the Indirect Transfer Provisions were mere clarifications. It is pertinent to note even though the ITAT favoured the tax department on all issues but one, while adjudging the issue on levy of interest on the tax payable, it observed that the tax liability of the Taxpayer has “arisen because of retrospective amendment made by the Finance Act, 2012”, tacitly lending credence to the view that the Indirect Transfer Provisions brought forth a new levy which had not existed previously. While the ITAT did not provide much detailed reasoning on the issue of static v. ambulatory approach in interpretation of tax treaties, the ruling in this regard is in consonance with the approach followed by most countries today and also with the Model Tax Convention on Income and on Capital, 2014 prepared by the Organisation of Economic Co-operation and Development. The ruling of the ITAT that interest may not be levied in the case is most certainly a welcome move which should provide some amount of comfort to other taxpayers who may be in a position similar to that of the Taxpayer and at a risk of shouldering an unforeseen tax burden. Moreover, it is hoped that CBDT may soon allay concerns surrounding issues regarding the retrograde positioning on retrospectivity, including liability of residents to deduct withholding taxes while making certain payments to non-residents, and payment of interest / penalties by the concerned non-resident. The ITAT did not touch upon the issue of the legal validity of the retrospective amendments and appropriately so. However, considering the quantum of tax liability in the case at hand, it is likely that the matter will be appealed before higher courts which possess the jurisdiction to adjudge the issue. Accordingly, it is pertinent to note that while the power of the Parliament to enact retrospective law is undisputed, the Supreme Court has in the past, while examining the effect of a retrospective imposition of tax, ruled that if any unforeseen financial burden were imposed on a taxpayer it would violate Article 19(1)(g)4 (the Freedom to practice trade and profession) of the Constitution of India, and that if a clarification which seeks to overturn a judicial decision results in an unreasonable new levy of tax by substantially changing a law, then it would be unconstitutional.5 Hence, various Constitutional rights and freedoms including the Right to Equality and the principles of natural justice may also be in play, should the matter go to a higher court, and the decision(s) of the concerned court(s) will have tremendous ramifications which may transcend the subject of taxation. In the short term, this is a blow to India’s image of a place that is serious about improving the ease of doing business and a quick final resolution of this issue does not seem likely in the near future. 1 (2012) 6 SCC 613 2 Please refer to our Tax Hotline on this for a more detailed analysis (available at http://www.nishithdesai.com/information/research-and-articles/nda-hotline/nda-hotline-single-view/article/draft-rules-on-capital-gains-on-indirect-transfer-of-assets-issued-challenging-times-for-global-ma.html?no_cache=1&cHash=4e116033e0e7f88164a1a47b00077a9a). 3 ITA. No. 473&474/2012 4 Ujagar Prints v. Union of India, (1989) 3 SCC 488 5 National Agricultural Co-operative Marketing Federation of India v. Union of India, (2003) 5 SCC 23

DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

-

The Delhi Bench of the Income Tax Appellate Tribunal upholds capital gains tax demand of Approx. INR 10,247 Crore (Approx. USD 1.565 Billion) on a transfer of shares of a Jersey company in 2006, which derived value from assets in India due to retrospective operation of indirect transfer law introduced in 2012.

-

Ambulatory approach / dynamic interpretation of tax treaties has been laid down.

-

Interest of Approx. INR 18,000 Crore (Approx. USD 2.75 Billion) claimed may not be levied in a case where the tax liability could not have been foreseen and the seller can’t be at fault for non-deduction by the buyer.

BACKGROUND

Explanations 4 and 5 to Section 9(1)(i) of the Income-tax Act, 1961 (“Indirect Transfer Provisions”) were introduced by way of the Finance Act, 2012 pursuant to the landmark ruling of the Supreme Court in Vodafone International Holdings BV v. Union of India1 (the “Vodafone case”) in which the Court held that transfer of shares of a Cayman Islands company would not be subject to capital gains tax in India, since the shares of the Cayman Islands company were not located in India. The Indirect Transfer Provisions were enacted with retrospective effect from 01/04/1962 and were styled as a clarification.

Over the past few months, the Central Board of Direct Taxes (“CBDT”) has taken a number of steps to ease concerns relating to this issue. In June, 2016 CBDT amended the Income-tax Rules, 1962 to provide for computation and fair market value and reporting requirements in relation to the Indirect Transfer Provisions.2 However, the Indirect Transfer Provisions continue to be applied in a harsh manner, which provides cause for grave concern and uncertainty.

FACTSCairn India Holdings Limited (“CIHL”) was incorporated in Jersey in August, 2006 as a wholly owned subsidiary of Cairn UK Holdings Limited (“CUHL” / “Taxpayer”), a holding company incorporated in the United Kingdom in June, 2006. Under a share exchange agreement between CUHL and CIHL, the former transferred shares constituting the entire issued share capital of nine subsidiaries of the Cairn group, held directly and indirectly by CUHL, that were engaged in the oil and gas sector in India (“Subsidiaries”). Thereafter, Cairn India Limited (“CIL”) was incorporated in India in August, 2006 as a wholly owned subsidiary of CUHL. By way of a subscription and share purchase agreement and a share purchase deed, shares constituting the entire issued share capital of CIHL were transferred to CIL (“Transaction”), the consideration for which was partly in cash and partly in the form of shares of CIL. CIL then divested 30.5% of its shareholding by way of an Initial Public Offering (“IPO”). As a result of divesting Approx. 30% of its stake in the Subsidiaries and part of IPO proceeds, CUHL received Approx. INR 6101 Crore (Approx. USD 931 Million).

In January, 2014, many years after the transaction was completed as per the existing law, the Assessing Officer (“AO”) initiated reassessment proceedings under Sections 147 and 148 of the Income-tax Act, 1961 (“ITA”) which provide for reassessment proceedings in cases where income has escaped assessment. The AO issued the draft assessment order in March, 2015, to which CUHL filed its objections before the Dispute Resolution Panel (“DRP”) under Section 144C of the ITA. The DRP issued its directions in December, 2015 and the AO drafted the final assessment order in January, 2016, determining the income of the Taxpayer arising from the Transaction at Approx. INR 24,500 Crore (Approx. USD 3.742 Billion) as short-term capital gains chargeable to tax at a 40% rate, subject to chargeability of surcharge and cess as applicable. As per the order, the taxpayer is also required to pay interest under Sections 234A and 234B of the ITA which provide for levy of interest in case of defaults in payment of taxes by a taxpayer, and penalty proceedings under the ITA were also initiated against the Taxpayer.

Aggrieved by such order, the Taxpayer preferred an appeal before the Income Tax Appellate Tribunal, Delhi bench (“ITAT”).

ARGUMENTS ADVANCEDThe Taxpayer made the following contentions:

-

The Indirect Transfer Provisions are bad in law and ultra vires the Right to Equality enshrined in the Constitution of India, and the Taxpayer should be assessed as per Section 9 of the ITA as it stood before the enactment of the Indirect Transfer Provisions by way of the Finance Act, 2012.

-

Since the Double Tax Avoidance Agreement between India and United Kingdom (“Tax Treaty”) was entered into in 1994, the Taxpayer should be taxed as per domestic law provisions as they existed in 1994.

-

The tax department has erred in interpreting Section 9 of the ITA as it stood before the enactment of the Indirect Transfer Provisions.

-

The facts in the case pertain to an internal reorganisation of the Cairn group without involving any sale or transfer to a third party, did not result in any change in the controlling interest and no tax may be levied on an internal reorganisation which does not result in any increase in wealth of the group.

-

Since the capital gains tax liability on account of the Transaction only arose pursuant to the enactment of the Indirect Transfer Provisions by way of the Finance Act, 2012, no interest should be levied in that regard and the penalty proceedings initiated should be dismissed.

The tax department put forth the following submissions:

-

The Indirect Transfer Provisions were only introduced as clarifications for the removal of doubts and the income of the Taxpayer in question was always and is taxable in India.

-

Under the Tax Treaty, capital gains is to be taxed in accordance with the domestic laws of each country as per Article 14 therein.

-

CUHL being a non-resident, any income accruing or arising to it, whether directly or indirectly, through the transfer of a capital asset situated in India shall be deemed to accrue or arise in India. Since CIHL shares derive substantial value from assets in India, they were situated in India.

-

There is no concept of group taxation in India, each assessee is taxed separately and the Transaction was a clear case of sale which resulted in capital gains.

-

The tax department also distinguished the impugned case from the Vodafone case on the ground that in the latter, it was a transfer of a foreign share between two non-residents while in the former, it was as transfer from a non-resident to a resident and hence the latter could not be applied.

The ITAT at the outset dismissed the Taxpayer’s argument regarding the legal validity of the retrospective amendments brought in by the Indirect Transfer Provisions, taking the view that the ITAT is not the appropriate forum to rule on the constitutional validity of the Indirect Transfer Provisions.

On the Taxpayer’s contention thst a ‘static’ approach ought to be employed in interpreting the Tax Treaty so as to tax assessees as per domestic law as it existed in 1994, the ITAT perused the ruling of the Delhi High Court in the case of DIT v. New Skies Satellite BV3 which was relied on by the Taxpayer. The ITAT observed that acts of Parliament may neither supply or alter the boundaries of a tax treaty, nor supply any redundancy to any part of the tax treaty. The ITAT then drew an analogy and opined that similarly, the provisions of a tax treaty cannot limit the boundaries of domestic tax laws. It therefore endorsed the ambulatory approach / dynamic interpretation of tax treaties whereby the tax treaty will be interpreted in light of current law as it exists.

The ITAT also took the view that the facts in the case at hand did not involve a simple internal reorganisation, since the entire series of transactions culminated in the IPO by way of which the Taxpayer received considerable gains. On perusing the financial statements of the Taxpayer the Court also observed that the Taxpayer had not paid any tax on the capital gains even in UK. Based on this and the view that tax treaties are intended to provide relief from double taxation, the ITAT held that the gains are chargeable to tax in India owing to the Indirect Transfer Provisions.

The ITAT did afford the taxpayer a lone breath of relief by ruling that the Taxpayer could not have previously visualized its tax liability in 2006 at the time of the Transaction and relied on various judicial pronouncements to ultimately hold that the Taxpayer cannot be burdened with the levy of interest as contended by the tax department.

However, moving to the last issue on the penalty proceedings under the ITA, the ITAT observed that the issue was premature and went on to dismiss that ground of the appeal.

In conclusion, the appeal of the Taxpayer was partly allowed, as regards the issue of payment of interest.

ANALYSISThe primary contention of the tax department which formed the bedrock for all other contentions raised by them, was that the income in question was always, and is taxable in India, since the shares of CIHL which were transferred by the Taxpayer derive their value substantially from assets situated in India, thus reemphasizing that the Indirect Transfer Provisions were mere clarifications. It is pertinent to note even though the ITAT favoured the tax department on all issues but one, while adjudging the issue on levy of interest on the tax payable, it observed that the tax liability of the Taxpayer has “arisen because of retrospective amendment made by the Finance Act, 2012”, tacitly lending credence to the view that the Indirect Transfer Provisions brought forth a new levy which had not existed previously.

While the ITAT did not provide much detailed reasoning on the issue of static v. ambulatory approach in interpretation of tax treaties, the ruling in this regard is in consonance with the approach followed by most countries today and also with the Model Tax Convention on Income and on Capital, 2014 prepared by the Organisation of Economic Co-operation and Development.

The ruling of the ITAT that interest may not be levied in the case is most certainly a welcome move which should provide some amount of comfort to other taxpayers who may be in a position similar to that of the Taxpayer and at a risk of shouldering an unforeseen tax burden. Moreover, it is hoped that CBDT may soon allay concerns surrounding issues regarding the retrograde positioning on retrospectivity, including liability of residents to deduct withholding taxes while making certain payments to non-residents, and payment of interest / penalties by the concerned non-resident.

The ITAT did not touch upon the issue of the legal validity of the retrospective amendments and appropriately so. However, considering the quantum of tax liability in the case at hand, it is likely that the matter will be appealed before higher courts which possess the jurisdiction to adjudge the issue. Accordingly, it is pertinent to note that while the power of the Parliament to enact retrospective law is undisputed, the Supreme Court has in the past, while examining the effect of a retrospective imposition of tax, ruled that if any unforeseen financial burden were imposed on a taxpayer it would violate Article 19(1)(g)4 (the Freedom to practice trade and profession) of the Constitution of India, and that if a clarification which seeks to overturn a judicial decision results in an unreasonable new levy of tax by substantially changing a law, then it would be unconstitutional.5 Hence, various Constitutional rights and freedoms including the Right to Equality and the principles of natural justice may also be in play, should the matter go to a higher court, and the decision(s) of the concerned court(s) will have tremendous ramifications which may transcend the subject of taxation.

In the short term, this is a blow to India’s image of a place that is serious about improving the ease of doing business and a quick final resolution of this issue does not seem likely in the near future.

1 (2012) 6 SCC 613

2 Please refer to our Tax Hotline on this for a more detailed analysis (available at http://www.nishithdesai.com/information/research-and-articles/nda-hotline/nda-hotline-single-view/article/draft-rules-on-capital-gains-on-indirect-transfer-of-assets-issued-challenging-times-for-global-ma.html?no_cache=1&cHash=4e116033e0e7f88164a1a47b00077a9a).

3 ITA. No. 473&474/2012

4 Ujagar Prints v. Union of India, (1989) 3 SCC 488

5 National Agricultural Co-operative Marketing Federation of India v. Union of India, (2003) 5 SCC 23

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersNew Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |