Tax HotlineOctober 01, 2008 Landmark Transfer Pricing Judgment sets new tax jurisprudence in IndiaThe Delhi Income-Tax Appellate Tribunal (“Tribunal”) recently pronounced a landmark ruling in the case of Sony India Private Limited (“Sony India”) clarifying various principles with respect to the Indian transfer pricing regulations as enshrined in the Income Tax Act, 1961 read with the Income Tax Rules, 1962. FACTS OF THE CASESony India is a wholly owned subsidiary of Sony Corporation, Japan (“Sony Japan”). Sony India is engaged in assembly and distribution of colour televisions and audio products and also the distribution of high-end electronic goods recordable media tapes, play stations, projectors and spare parts required for these goods imported from its foreign associated enterprises (“AEs”). Sony India also renders advisory services and software development services to its AEs. The revenues of Sony India are generated mainly from assembly and sale of colour televisions and trading of other electronic goods. A diagrammatic representation of the structure of Sony India and its AEs is depicted in the chart below: The extant Indian Transfer Pricing Regulations require Sony India to conduct all transactions with its AEs at an Arm’s Length Price (“ALP”). Sony India claimed that all its international transactions were undertaken at ALP and for this purpose relied upon Transactional Net Margin Method (“TNMM”). For the purpose of calculating the ALP, Sony India had chosen the foreign AEs from whom the components were imported as tested parties and computed the profits of AEs with Indian comparables chosen from Indian data base. The same method was chosen for the distribution activities relating to high-end electronic products, projector tapes etc. where Sony India was taken as the tested party. However, the Transfer Pricing Officer (“TPO”) did not agree that foreign AEs could be taken as tested parties for determining the ALP and accordingly asked Sony India to submit fresh transfer pricing report taking Sony India as a tested party and Indian entities as comparable. The TPO made certain transfer pricing adjustments to the income of Sony India which were adopted by the Assessing Officer. Sony India approached the Commissioner of Income Tax against the transfer pricing adjustment made by the Assessing Officer and the TPO. The Commissioner of Income Tax partially upheld the assessment made by the Assessing Officer and thereafter, Sony India approached the Tribunal in this regard. DECISION OF THE TRIBUNALThe Tribunal heard the parties at length and thereafter pronounced a detailed order dealing with the various issues at hand. The Tribunal placed heavy reliance upon the on the rulings in M/s Aztec Software & Technology Services Ltd. vs. ACIT1 and in Mentor Graphics (Noida) Pvt. Ltd. vs. Dy. CIT2 wherein the principles applicable under the Indian transfer pricing regulations were discussed elaborately. The Tribunal also made references to the International jurisprudence with respect to transfer pricing where the Indian law and jurisprudence is lacking. The order of the Tribunal has been summarized hereunder: Doctrine of Form over Substance The Tribunal discussed the doctrine of form over substance and held that fiscal laws require that actual transactions entered into between parties should be given due consideration and the tax authorities should not unnecessarily try and read between lines. It further observed that the tax authorities had no right whatsoever to re-write the transaction unless the transaction is sham or bogus and has been entered into in bad faith for the purpose of evading tax. It also examined and concurred with the OECD Regulations and the US Transfer Pricing Regulations which provide that the agreements entered into between the parties should be respected if the terms are consistent with economic substance of the underlying transaction. Comparables with related party transactions The Tribunal also discussed the controversy with respect to the selection of comparables for the purpose of the transfer pricing analysis. It made an observation to the effect that an entity can be taken as a comparable for the purpose of economic analysis if its related party transactions do not exceed 10 to 15% of its total revenue and that within this limit, transactions could not be held to be significant to influence the profitability of the comparable. Use of Loss making comparables The Tribunal also mentioned that the argument of the tax authorities with respect to rejection of loss making companies was untenable. It observed that factors such as losses should not be considered singly but the cumulative effect of the same along with other factors should be taken into consideration. Emphasis on broader set of comparables The Tribunal referred to the OECD guidelines to emphasize that a large number of similar entities should be taken as comparables to make a broad based comparison for the purpose of determining the ALP. Transfer Pricing Adjustments The Tribunal also held that appropriate adjustments are required to be made to account for material differences. It observed that while comparing controlled and uncontrolled transactions or enterprises, one has to be careful of the differences and one should consider whether such differences were likely to affect the price, cost charged or paid or the profits arising from the transaction in the open market. It was thereafter important to make reasonable accurate adjustments to eliminate the material effect of the differences between the transactions or entities. If a reasonable accurate adjustment for the difference to eliminate material effect of the differences could not be made practically, then such comparables (uncontrolled) should be rejected. Inclusion of certain items in operating income The Tribunal allowed the inclusion of certain items in operating income such as the reimbursement of advertisement expenses received from one of the AEs. The Tribunal opined that the argument of Sony India that it would not have incurred such huge expenses on advertisement but for agreement of reimbursement was acceptable. On the basis of the facts at hand, the Tribunal held that such reimbursements should be a part of the normal operating profits of Sony India. Export of color TVs to Sony Japan As regards the export of colour TV sets to Sony Japan, Sony India has made a claim that these TVs were assembled and exported to Sony Japan for the purpose of utilizing idle capacity of assembling facilities and therefore, to enable the company to improve recovery of its fixed assembly cost. The Tribunal held that under-utilization of capacity could not justify export of Colour TVs at a price less than the price to any unrelated party. The Tribunal further observed that it was essential to show that similar prices were being charged for similar products in identical circumstances. Deduction on account of intangibles, R&D etc. The Tribunal also allowed a deduction of 20% on account of differences in ownership of intangibles and research and development. The Tribunal also allowed adjustments on account of working capital. Adjustment of + / - 5 percent of the arithmetic mean The Tribunal placed reliance on the judgment by the Kolkata Tribunal3 and held that Sony India was entitled to the benefits of second part of the proviso to Section 92C(2) of the Income Tax Act irrespective of the fact that price of international transaction disclosed by them exceeds the margin ( +/- 5% to the arithmetic mean) provided in the provisio. CONCLUSIONThis judgment sets the pace for the gradual evolution of Indian transfer pricing jurisprudence. This order of the Tribunal is being welcomed by all quarters because of the pragmatic approach taken by the Tribunal on various issues which needed clarification for a long time. DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

The Delhi Income-Tax Appellate Tribunal (“Tribunal”) recently pronounced a landmark ruling in the case of Sony India Private Limited (“Sony India”) clarifying various principles with respect to the Indian transfer pricing regulations as enshrined in the Income Tax Act, 1961 read with the Income Tax Rules, 1962.

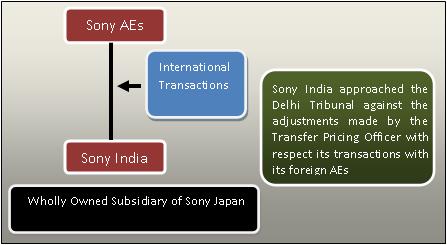

FACTS OF THE CASESony India is a wholly owned subsidiary of Sony Corporation, Japan (“Sony Japan”). Sony India is engaged in assembly and distribution of colour televisions and audio products and also the distribution of high-end electronic goods recordable media tapes, play stations, projectors and spare parts required for these goods imported from its foreign associated enterprises (“AEs”). Sony India also renders advisory services and software development services to its AEs. The revenues of Sony India are generated mainly from assembly and sale of colour televisions and trading of other electronic goods. A diagrammatic representation of the structure of Sony India and its AEs is depicted in the chart below:

The extant Indian Transfer Pricing Regulations require Sony India to conduct all transactions with its AEs at an Arm’s Length Price (“ALP”). Sony India claimed that all its international transactions were undertaken at ALP and for this purpose relied upon Transactional Net Margin Method (“TNMM”). For the purpose of calculating the ALP, Sony India had chosen the foreign AEs from whom the components were imported as tested parties and computed the profits of AEs with Indian comparables chosen from Indian data base. The same method was chosen for the distribution activities relating to high-end electronic products, projector tapes etc. where Sony India was taken as the tested party. However, the Transfer Pricing Officer (“TPO”) did not agree that foreign AEs could be taken as tested parties for determining the ALP and accordingly asked Sony India to submit fresh transfer pricing report taking Sony India as a tested party and Indian entities as comparable. The TPO made certain transfer pricing adjustments to the income of Sony India which were adopted by the Assessing Officer.

Sony India approached the Commissioner of Income Tax against the transfer pricing adjustment made by the Assessing Officer and the TPO. The Commissioner of Income Tax partially upheld the assessment made by the Assessing Officer and thereafter, Sony India approached the Tribunal in this regard.

DECISION OF THE TRIBUNALThe Tribunal heard the parties at length and thereafter pronounced a detailed order dealing with the various issues at hand. The Tribunal placed heavy reliance upon the on the rulings in M/s Aztec Software & Technology Services Ltd. vs. ACIT1 and in Mentor Graphics (Noida) Pvt. Ltd. vs. Dy. CIT2 wherein the principles applicable under the Indian transfer pricing regulations were discussed elaborately. The Tribunal also made references to the International jurisprudence with respect to transfer pricing where the Indian law and jurisprudence is lacking.

The order of the Tribunal has been summarized hereunder:

Doctrine of Form over Substance

The Tribunal discussed the doctrine of form over substance and held that fiscal laws require that actual transactions entered into between parties should be given due consideration and the tax authorities should not unnecessarily try and read between lines. It further observed that the tax authorities had no right whatsoever to re-write the transaction unless the transaction is sham or bogus and has been entered into in bad faith for the purpose of evading tax. It also examined and concurred with the OECD Regulations and the US Transfer Pricing Regulations which provide that the agreements entered into between the parties should be respected if the terms are consistent with economic substance of the underlying transaction.

Comparables with related party transactions

The Tribunal also discussed the controversy with respect to the selection of comparables for the purpose of the transfer pricing analysis. It made an observation to the effect that an entity can be taken as a comparable for the purpose of economic analysis if its related party transactions do not exceed 10 to 15% of its total revenue and that within this limit, transactions could not be held to be significant to influence the profitability of the comparable.

Use of Loss making comparables

The Tribunal also mentioned that the argument of the tax authorities with respect to rejection of loss making companies was untenable. It observed that factors such as losses should not be considered singly but the cumulative effect of the same along with other factors should be taken into consideration.

Emphasis on broader set of comparables

The Tribunal referred to the OECD guidelines to emphasize that a large number of similar entities should be taken as comparables to make a broad based comparison for the purpose of determining the ALP.

Transfer Pricing Adjustments

The Tribunal also held that appropriate adjustments are required to be made to account for material differences. It observed that while comparing controlled and uncontrolled transactions or enterprises, one has to be careful of the differences and one should consider whether such differences were likely to affect the price, cost charged or paid or the profits arising from the transaction in the open market. It was thereafter important to make reasonable accurate adjustments to eliminate the material effect of the differences between the transactions or entities. If a reasonable accurate adjustment for the difference to eliminate material effect of the differences could not be made practically, then such comparables (uncontrolled) should be rejected.

Inclusion of certain items in operating income

The Tribunal allowed the inclusion of certain items in operating income such as the reimbursement of advertisement expenses received from one of the AEs. The Tribunal opined that the argument of Sony India that it would not have incurred such huge expenses on advertisement but for agreement of reimbursement was acceptable. On the basis of the facts at hand, the Tribunal held that such reimbursements should be a part of the normal operating profits of Sony India.

Export of color TVs to Sony Japan

As regards the export of colour TV sets to Sony Japan, Sony India has made a claim that these TVs were assembled and exported to Sony Japan for the purpose of utilizing idle capacity of assembling facilities and therefore, to enable the company to improve recovery of its fixed assembly cost. The Tribunal held that under-utilization of capacity could not justify export of Colour TVs at a price less than the price to any unrelated party. The Tribunal further observed that it was essential to show that similar prices were being charged for similar products in identical circumstances.

Deduction on account of intangibles, R&D etc.

The Tribunal also allowed a deduction of 20% on account of differences in ownership of intangibles and research and development. The Tribunal also allowed adjustments on account of working capital.

Adjustment of + / - 5 percent of the arithmetic mean

The Tribunal placed reliance on the judgment by the Kolkata Tribunal3 and held that Sony India was entitled to the benefits of second part of the proviso to Section 92C(2) of the Income Tax Act irrespective of the fact that price of international transaction disclosed by them exceeds the margin ( +/- 5% to the arithmetic mean) provided in the provisio.

CONCLUSIONThis judgment sets the pace for the gradual evolution of Indian transfer pricing jurisprudence. This order of the Tribunal is being welcomed by all quarters because of the pragmatic approach taken by the Tribunal on various issues which needed clarification for a long time.

_________________________

Source: Delhi Income Tax Appellate Tribunal ruling – M/s Sony India (P) Ltd. v. DCIT

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |