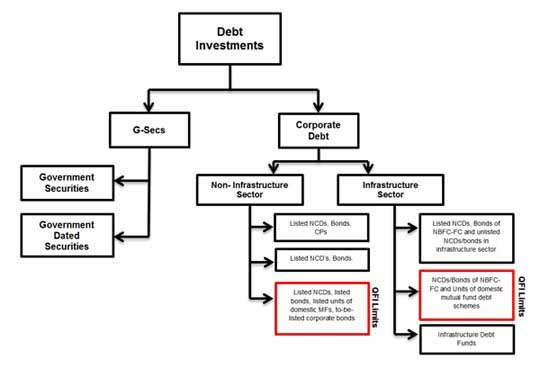

Funds HotlineApril 16, 2013 Foreign Debt Encouraged - Government Rationalises Debt AllocationsAt a time when India’s current account deficit stands at a record high, the Finance Minister has kicked of a spade of reforms to rationalize and simplify the route of debt investment into India. The Finance Minister speaking at a conference on March 23, 20131 pointed out that the current account deficit can be financed through foreign inflows, on account of which he announced a major rationalisation of foreign investment in government securities and corporate bonds. Accordingly, the various sub-limits for investment in debt in India have now been broadly merged into two categories – government debt and corporate debt, vide two circulars issued by the Reserve Bank of India (“RBI”)2 and Securities and Exchange Board of India (“SEBI”)3 (together, referred to as the “Circulars”). More importantly, the process for allocating limits through auctions has been liberalized significantly, as now until overall investment reaches 90% of the total debt limit, investments can be made by eligible investors without going through the auction process. EARLIER POSITION Foreign Investment in rupee denominated debt instruments till date has been largely classified into government and corporate securities. Under these two major classifications several sub-limits were created with varying limits based on the investor, instrument, maturity, sector and lock-in etc., which over a period of time became increasingly complex To broadly summarize the limits as they stood, the G-secs (or government securities) overall limit stood at USD 25 billion with a split of USD 10 billion allotted to government securities and USD 15 billion allotted to government dated securities. Further, the corporate debt of USD 51 billion stood divided as follows – (i) Qualified Foreign Investors (“QFIs”) – USD 1 billion; (ii) non-infrastructure sector corporate debt securities - USD 25 billon; and (iii) infrastructure sector - USD 25 billion. These limits were in turn sub-classified based the factors mentioned above. The table herein below illustrates the various broad categories in which the debt limits were categorized:

REVISED POSITION Removal of sub-limits Post April 1, 2013, SEBI and RBI have vide the Circulars merged the existing debt limits into two broad categories as under:

The table herein below (reproduced from the RBI circular) summarizes the revised position on debt categories:

Limits available on tap Previously an FII / sub-account which had acquired or obtained investment limits from SEBI, had the flexibility to reinvest into debt securities after the initial investment had been sold off or had matured, subject to certain restrictions as stipulated in SEBI Circulars No. CIR/IMD/FIIC/1/2012 dated January 3, 2012, No. CIR/IMD/FIIC/22/2012 dated November 7, 2012 and No. CIR/IMD/FIIC/1/2013 dated January 1, 2013 (together, the “SEBI Debt Limit Circulars”). However, the Circulars have allowed FII / sub-account, along with QFIs to invest in corporate debt without purchasing debt limits till the overall investment reaches 90% of USD 51 billion (i.e. USD 45.9 billion) after which the auction mechanism would be initiated for allocation of the remaining limits. Further, it is provided that the facility of re-investment and the restrictions thereon as per SEBI Debt Limit Circulars shall not apply to the limit held or investments made by FII / sub account within the initial 90% of the available debt investment limit of USD 51 billion for Corporate Debt (USD 45.9 billion). CONCLUSION The rationalization of sub-limits will be welcomed by FIIs and other investors who will now seek to take up the under-utilized sub-limits through the “on tap” mechanism. With the finance minister encouraging foreign rupee denominated debt to cope up the current account deficit, a larger number of foreign players are likely to tap this route for investing into India. Extending the same principle of usage of 90% of debt limits ‘on tap’ to the entire USD 51 billion limit, is a huge boon to the investment community, especially on two counts – (i) this would reduce the cost of the investor; and (ii) the investor would no longer be under an uncertainty as to whether would be able to acquire the debt limits, which became a huge concern especially when the ability to re-utilize the debt limits available was restricted under the SEBI Debt Limit Circulars. Availability, allocation and expiry of debt limits and bidding for them were one of the largest challenges that were keeping foreign investors from considering such listed debt instruments. However, with such simplification and importantly buy-backs being now subjected to an additional tax of 20%, foreign investors are likely to take the structured debt route for investing into India, especially in those classes where returns are expected by way of cash up-streaming.

1 Press Information Burea, Government of India, Rationalisation of Foreign Investment in Government Securities and Corporate Bonds to be Operational by April 1, 2013: FM, available at http://pib.nic.in/newsite/mbErel.aspx?relid=94260 (last visited on April 04, 2013). 2 Reserve Bank of India, A.P. (DIR Series) Circular No.94 dated April 1, 2013. 3 Securities and Exchange Board of India, Circular CIR/IMD/FIIC/6/2013 dated April 1, 2013. (“SEBI Circular”) DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

At a time when India’s current account deficit stands at a record high, the Finance Minister has kicked of a spade of reforms to rationalize and simplify the route of debt investment into India. The Finance Minister speaking at a conference on March 23, 20131 pointed out that the current account deficit can be financed through foreign inflows, on account of which he announced a major rationalisation of foreign investment in government securities and corporate bonds. Accordingly, the various sub-limits for investment in debt in India have now been broadly merged into two categories – government debt and corporate debt, vide two circulars issued by the Reserve Bank of India (“RBI”)2 and Securities and Exchange Board of India (“SEBI”)3 (together, referred to as the “Circulars”). More importantly, the process for allocating limits through auctions has been liberalized significantly, as now until overall investment reaches 90% of the total debt limit, investments can be made by eligible investors without going through the auction process.

EARLIER POSITION

Foreign Investment in rupee denominated debt instruments till date has been largely classified into government and corporate securities. Under these two major classifications several sub-limits were created with varying limits based on the investor, instrument, maturity, sector and lock-in etc., which over a period of time became increasingly complex

To broadly summarize the limits as they stood, the G-secs (or government securities) overall limit stood at USD 25 billion with a split of USD 10 billion allotted to government securities and USD 15 billion allotted to government dated securities. Further, the corporate debt of USD 51 billion stood divided as follows – (i) Qualified Foreign Investors (“QFIs”) – USD 1 billion; (ii) non-infrastructure sector corporate debt securities - USD 25 billon; and (iii) infrastructure sector - USD 25 billion. These limits were in turn sub-classified based the factors mentioned above. The table herein below illustrates the various broad categories in which the debt limits were categorized:

REVISED POSITION

Removal of sub-limits

Post April 1, 2013, SEBI and RBI have vide the Circulars merged the existing debt limits into two broad categories as under:

- Government Debt limit: Government securities of USD 25 billion by merging the existing sub-limits under Government securities, that is, (a) USD 10 billion for investment by foreign institutional investors (“FIIs”) in government securities including treasury bills and (b) USD 15 billion for investment In government dated securities by FIIs and long term investors; and

- Corporate Debt Limit: Corporate debt of USD 51 billion by merging the existing sub-limits of corporate debt, that is, (a) USD 1 billion for QFIs, (b) USD 25 billon for investment by FIIs and long term investors in non-infrastructure sector and (c) USD 25 billion for investment by FIIs/QFIs/long term investors in infrastructure sector.

The table herein below (reproduced from the RBI circular) summarizes the revised position on debt categories:

| S. NO. | DEBT CATEGORY | CAP IN USD | CAP IN INR | ELIGIBLE INVESTORS | REMARKS |

|---|---|---|---|---|---|

| 1 | Government Debt | 25 | 124,432 | FIIs and QFIs | Eligible investors may invest in Treasury Bills only up to USD 5.5 billion within the limit of USD 25 billion |

| 2 | Corporate Debt | 51 | 244,323 | FIIs and QFIs | Eligible investors may invest in Commercial Papers only up to USD 3.5 billion within the limit of USD 51 billion |

| Total | 76 | 368,755 |

Limits available on tap

Previously an FII / sub-account which had acquired or obtained investment limits from SEBI, had the flexibility to reinvest into debt securities after the initial investment had been sold off or had matured, subject to certain restrictions as stipulated in SEBI Circulars No. CIR/IMD/FIIC/1/2012 dated January 3, 2012, No. CIR/IMD/FIIC/22/2012 dated November 7, 2012 and No. CIR/IMD/FIIC/1/2013 dated January 1, 2013 (together, the “SEBI Debt Limit Circulars”).

However, the Circulars have allowed FII / sub-account, along with QFIs to invest in corporate debt without purchasing debt limits till the overall investment reaches 90% of USD 51 billion (i.e. USD 45.9 billion) after which the auction mechanism would be initiated for allocation of the remaining limits. Further, it is provided that the facility of re-investment and the restrictions thereon as per SEBI Debt Limit Circulars shall not apply to the limit held or investments made by FII / sub account within the initial 90% of the available debt investment limit of USD 51 billion for Corporate Debt (USD 45.9 billion).

CONCLUSION

The rationalization of sub-limits will be welcomed by FIIs and other investors who will now seek to take up the under-utilized sub-limits through the “on tap” mechanism. With the finance minister encouraging foreign rupee denominated debt to cope up the current account deficit, a larger number of foreign players are likely to tap this route for investing into India.

Extending the same principle of usage of 90% of debt limits ‘on tap’ to the entire USD 51 billion limit, is a huge boon to the investment community, especially on two counts – (i) this would reduce the cost of the investor; and (ii) the investor would no longer be under an uncertainty as to whether would be able to acquire the debt limits, which became a huge concern especially when the ability to re-utilize the debt limits available was restricted under the SEBI Debt Limit Circulars.

Availability, allocation and expiry of debt limits and bidding for them were one of the largest challenges that were keeping foreign investors from considering such listed debt instruments. However, with such simplification and importantly buy-backs being now subjected to an additional tax of 20%, foreign investors are likely to take the structured debt route for investing into India, especially in those classes where returns are expected by way of cash up-streaming.

– Prasad Subramanyan, Deepak Jodhani & Ruchir Sinha

You can direct your queries or comments to the authors

1 Press Information Burea, Government of India, Rationalisation of Foreign Investment in Government Securities and Corporate Bonds to be Operational by April 1, 2013: FM, available at http://pib.nic.in/newsite/mbErel.aspx?relid=94260 (last visited on April 04, 2013).

2 Reserve Bank of India, A.P. (DIR Series) Circular No.94 dated April 1, 2013.

3 Securities and Exchange Board of India, Circular CIR/IMD/FIIC/6/2013 dated April 1, 2013. (“SEBI Circular”)

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMedical Device Industry in India Clinical Trials and Biomedical Research in India |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |