Other HotlineDecember 19, 2011 Report of the DTC Global Think TankConvened by: Nishith Desai Associates Comprising: Al Meghji, Arvid Skaar, Bharat Vasani, David Sutherland, Elinore Richardson, David Rosenbloom, John McDonald, John Prebble, Keki Mistry, Luís Eduardo Schoueri, Nishith Desai, Peter Barnes, Philip Baker, Pieter de Ridder, Som Mittal, TP Ostwal, Published by: Taxmann Publications Pvt. Ltd. We are happy to announce the release of our latest publication: International Dimensions of the Direct Taxes Code, 2010: Report of the DTC Global Think Tank. Published by Taxmann, this work is a must-have for all tax practitioners, researchers, policy thinkers, professionals, MNCs, universities and students interested in obtaining a better understanding of key technical and policy issues surrounding the proposed Direct Taxes Code (DTC) Bill, 2010. The DTC Bill, proposed to be introduced from April 1, 2012 has created ripples within the professional and business community. From comprehensive general anti-avoidance rules (GAAR), a new controlled foreign corporation framework, shift in the concept of corporate residence and other radical policy changes, the new Code is poised to fundamentally impact the way the world invests in and does business with India. The proposed code is currently being scrutinized by the Indian Parliament. Taking the opportunity to provide comments and recommendations on the new Code, the DTC Global Think Tank convened by Nishith Desai Associates analyses some of its key international dimensions. The members of the DTC Global Think Tank have significant expertise and experience in international tax policy and include renowned academicians, jurists, public policy experts and industry leaders from around the world. The Report of the DTC Global Think Tank provides interesting insights and an objective assessment of legal, constitutional and international law implications of specific DTC proposals that impact the global business community. It also provides a constructive critique of the manner in which India has embraced this mammoth task of overhauling its tax law and provides recommendations based on international best practices. The members of the Think Tank argue in favour of a robust, fair, stable, sustainable and trust based tax regime that would enhance India’s participation in international trade and investment flows and facilitate its emergence as a responsible economic power. ORDER NOW @ the Taxmann Online Book Store: http://www.taxmann.com/bookstore/professional/direct-taxes-code-global-think-tank.aspx Price: INR 2,100 / USD 60 (Inclusive of delivery charges worldwide)

DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

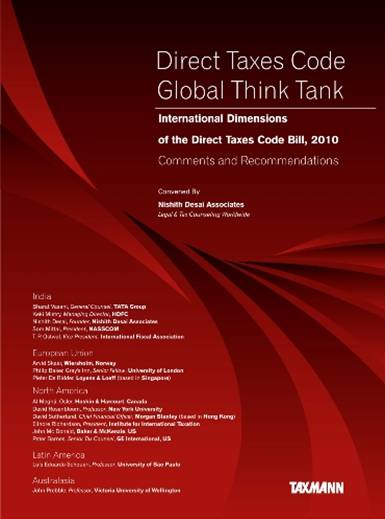

Convened by: Nishith Desai Associates

Comprising: Al Meghji, Arvid Skaar, Bharat Vasani, David Sutherland, Elinore Richardson, David Rosenbloom, John McDonald, John Prebble, Keki Mistry, Luís Eduardo Schoueri, Nishith Desai, Peter Barnes, Philip Baker, Pieter de Ridder, Som Mittal, TP Ostwal,

Published by: Taxmann Publications Pvt. Ltd.

We are happy to announce the release of our latest publication: International Dimensions of the Direct Taxes Code, 2010: Report of the DTC Global Think Tank. Published by Taxmann, this work is a must-have for all tax practitioners, researchers, policy thinkers, professionals, MNCs, universities and students interested in obtaining a better understanding of key technical and policy issues surrounding the proposed Direct Taxes Code (DTC) Bill, 2010.

The DTC Bill, proposed to be introduced from April 1, 2012 has created ripples within the professional and business community. From comprehensive general anti-avoidance rules (GAAR), a new controlled foreign corporation framework, shift in the concept of corporate residence and other radical policy changes, the new Code is poised to fundamentally impact the way the world invests in and does business with India.

The proposed code is currently being scrutinized by the Indian Parliament. Taking the opportunity to provide comments and recommendations on the new Code, the DTC Global Think Tank convened by Nishith Desai Associates analyses some of its key international dimensions. The members of the DTC Global Think Tank have significant expertise and experience in international tax policy and include renowned academicians, jurists, public policy experts and industry leaders from around the world.

The Report of the DTC Global Think Tank provides interesting insights and an objective assessment of legal, constitutional and international law implications of specific DTC proposals that impact the global business community. It also provides a constructive critique of the manner in which India has embraced this mammoth task of overhauling its tax law and provides recommendations based on international best practices. The members of the Think Tank argue in favour of a robust, fair, stable, sustainable and trust based tax regime that would enhance India’s participation in international trade and investment flows and facilitate its emergence as a responsible economic power.

ORDER NOW @ the Taxmann Online Book Store:

http://www.taxmann.com/bookstore/professional/direct-taxes-code-global-think-tank.aspx

Price: INR 2,100 / USD 60 (Inclusive of delivery charges worldwide)

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |