Companies Act SeriesJune 04, 2014 Companies Act 2013: Greater emphasis on governance through the board and board processes

The Government of India has recently notified Companies Act, 2013 (“CA 2013”), which replaces the erstwhile Companies Act, 1956 (“CA 1956”). In our series of updates on the CA 2013 (“NDA CA 2013 Series”), we are analyzing the key changes and their major implications for stakeholders, by setting out the practical impact of the changes introduced by CA 2013. For a quick look at our analysis so far on the changes brought forth by the CA 2013, please refer to our previous hotlines in this series available through this link. In this hotline, we shall analyse the important changes introduced by CA 2013 with respect to management and administration of companies. The changes in law are aimed at ensuring higher standards of transparency and accountability, and seek to align the corporate governance practices in India with global best practices. KEY CHANGES INTRODUCED BY CA 2013I. BOARD COMPOSITIONCA 2013 has introduced significant changes in the composition of the board of directors of a company. The key changes introduced are set out below: NUMBER OF DIRECTORS: The following key changes have been introduced regarding composition of the board:

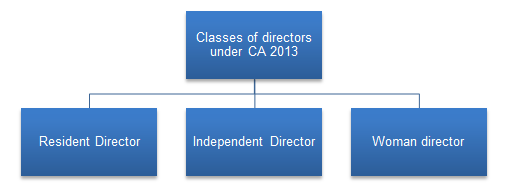

CA 2013 requires companies to have the following classes of directors:

RESIDENT DIRECTOR: CA 2013 introduces the requirement of appointing a resident director, i.e., a person who has stayed in India for a total period of not less than 182 (one hundred and eighty two) days in the previous calendar year.

INDEPENDENT DIRECTORS CA 1956 did not require companies to appoint an independent director on its board. Provisions related to independent directors were set out in Clause 49 of the Listing Agreement (“Listing Agreement”). a) Number of independent directors: As per the Listing Agreement, only listed companies were required to appoint independent directors. The number of independent directors on the board of a listed company was required to be equal to (i) one third of the board, where the chairman of the board is a non-executive director; or (ii) one half of the board, where the chairman is an executive director. However, under CA 2013, the following companies are required to appoint independent directors: (i) Public listed company: Atleast one third of the board to be comprised of independent directors; and (ii) Certain specified companies that meet the criteria listed below are required to have atleast 2 (two) independent directors:

b) Qualification criteria: (i) CA 2013 prescribes detailed qualifications for the appointment of an independent director on the board of a company. Some important qualifications include:

(ii) CA 2013 also sets forth stringent provisions with respect to the relatives of the independent director.

Observations: CA 2013 proposes to significantly escalate the independence requirements of independent directors, when compared to the Listing Agreement:

c) Duties of independent directors: Neither the Listing Agreement nor the CA 1956 prescribed the scope of duties of independent directors. CA 2013 includes a guide to professional conduct for independent directors, which crystallizes the role of independent directors by prescribing facilitative roles, such as offering independent judgment on issues of strategy, performance and key appointments, and taking an objective view on performance evaluation of the board. Independent directors are additionally required to satisfy themselves on the integrity of financial information, to balance the conflicting interests of all stakeholders and, in particular, to protect the rights of the minority shareholders. The SEBI Circular however, states that the board is required to lay down a code of conduct which would incorporate the duties of independent directors as set out in CA 2013.

d) Liability of independent directors Under CA 1956, independent directors were not considered to be “officers in default” and consequently were not liable for the actions of the board. CA 2013 however, provides that the liability of independent directors would be limited to acts of omission or commission by a company which occurred with their knowledge, attributable through board processes, and with their consent and connivance or where they have not acted diligently.

e) Position of Nominee Directors

Duties of directors CA 1956 did not contain any provisions that specifically identified the duties of directors. CA 2013 has set out the following duties of directors:

The director is not permitted to:

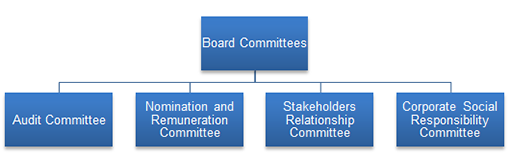

II. COMMITTEES OF THE BOARDCA 2013 envisages 4 (four) types of committees to be constituted by the board:

a) AUDIT COMMITTEE: Under CA 1956, public companies with a paid up capital in excess of INR 50,000,000 (Rupees fifty million only) were required to set up an audit committee comprising of not less than 3 (three) directors. Atleast one third had to be comprised of directors other than Managing Directors or Whole Time Directors. CA 2013 however, requires the board of every listed company and certain other public companies to constitute the audit committee consisting of a minimum of 3 (three) directors, with the independent directors forming a majority. It prescribes that a majority of members, including its Chairman, have to be persons with the ability to read and understand financial statements. The audit committee has been entrusted with the task of providing recommendations for appointment and remuneration of auditors, review of independence of auditors, providing approval of related party transactions and scrutiny over other financial mechanisms of the company. b) NOMINATION AND REMUNERATION COMMITTEE: While CA 1956 did not require companies to set up nomination and remuneration committee, the Listing Agreement provided companies with the option to constitute a remuneration committee. However, CA 2013 requires the board of every listed company to constitute the Nomination and Remuneration Committee consisting of 3 (three) or more non-executive directors out of which not less than one half are required to be independent directors. The committee has the task of identifying persons who are qualified to become directors and provide recommendations to the board regarding their appointment and removal, as well as carry out their performance evaluation. c) STAKEHOLDERS RELATIONSHIP COMMITTEE: CA 1956 did not require a company to set up a stakeholder’s relationship committee. The Listing Agreement required listed companies to set up a shareholders / investors grievance committee to examine complaints and issues of shareholders. CA 2013 requires every company having more than 1000 (one thousand) shareholders, debenture holders, deposit holders and any other security holders at any time during a financial year to constitute a stakeholders relationship committee to resolve the grievances of security holders of the company. d) CORPORATE SOCIAL RESPONSIBILITY COMMITTEE (“CSR Committee”): CA 1956 did not impose any requirement on companies relating to corporate social responsibility (“CSR”). CA 2013 however, requires certain companies to constitute a CSR Committee, which would be responsible to devise, recommend and monitor CSR initiatives of the company. The committee is also required to prepare a report detailing the CSR activities undertaken and if not, the reasons for failure to comply.

III. BOARD MEETINGS AND PROCESSESThe key changes introduced by CA 2013 with respect to board meetings and processes are as under:

CONCLUSIONCA 2013 has introduced significant changes regarding the board composition and has a renewed focus on board processes. Whilst certain of these changes may seem overly prescriptive, a closer analysis leads to a compelling conclusion that the emphasis is on board processes, which over a period of time would institutionalize good corporate governance and not make governance over-dependent on the presence of certain individuals on the board.

You can direct your queries or comments to the authors 1 http://www.sebi.gov.in/cms/sebi_data/attachdocs/1397734478112.pdf DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

- CA 2013 introduces significant changes to the composition of the boards of directors.

- Every company is required to appoint 1 (one) resident director on its board.

- Nominee directors shall no longer be treated as independent directors.

- Listed companies and specified classes of public companies are required to appoint independent directors and women directors on their boards.

- CA 2013 for the first time codifies the duties of directors.

- SEBI amends the Listing Agreement (with prospective effect from October 01, 2014) to align it with CA 2013.

The Government of India has recently notified Companies Act, 2013 (“CA 2013”), which replaces the erstwhile Companies Act, 1956 (“CA 1956”). In our series of updates on the CA 2013 (“NDA CA 2013 Series”), we are analyzing the key changes and their major implications for stakeholders, by setting out the practical impact of the changes introduced by CA 2013. For a quick look at our analysis so far on the changes brought forth by the CA 2013, please refer to our previous hotlines in this series available through this link.

In this hotline, we shall analyse the important changes introduced by CA 2013 with respect to management and administration of companies. The changes in law are aimed at ensuring higher standards of transparency and accountability, and seek to align the corporate governance practices in India with global best practices.

KEY CHANGES INTRODUCED BY CA 2013I. BOARD COMPOSITION

CA 2013 has introduced significant changes in the composition of the board of directors of a company. The key changes introduced are set out below:

NUMBER OF DIRECTORS: The following key changes have been introduced regarding composition of the board:

- A one person company shall have a minimum of 1 (one) director;

- CA 1956 permitted a company to determine the maximum number of directors on its board by way of its articles of association. CA 2013, however, specifically provides that a company may have a maximum of 15 (fifteen) directors.

- CA 1956 required public companies to obtain Central Government’s approval for increasing the number of its directors above the limit prescribed in its articles or if such increase would lead to the total number of directors on the board exceeding 12 (twelve) directors. CA 2013 however, permits every company to appoint directors above the prescribed limit of 15 (fifteen) by authorizing such increase through a special resolution.

|

Key takeaway: Allowing companies to increase the maximum number of directors on their boards by way of a special resolution would ensure greater flexibility to companies. |

CA 2013 requires companies to have the following classes of directors:

RESIDENT DIRECTOR: CA 2013 introduces the requirement of appointing a resident director, i.e., a person who has stayed in India for a total period of not less than 182 (one hundred and eighty two) days in the previous calendar year.

|

Key Takeaway: The requirement to have a resident director on the board of companies has been viewed as a move to ensure that boards of Indian companies do not comprise entirely of non-resident directors. This provision has caused significant difficulties to companies, since it has been brought into force with immediate effect, requiring companies to restructure their boards immediately to ensure compliance with CA 2013. |

INDEPENDENT DIRECTORS

CA 1956 did not require companies to appoint an independent director on its board. Provisions related to independent directors were set out in Clause 49 of the Listing Agreement (“Listing Agreement”).

a) Number of independent directors: As per the Listing Agreement, only listed companies were required to appoint independent directors. The number of independent directors on the board of a listed company was required to be equal to (i) one third of the board, where the chairman of the board is a non-executive director; or (ii) one half of the board, where the chairman is an executive director. However, under CA 2013, the following companies are required to appoint independent directors:

(i) Public listed company: Atleast one third of the board to be comprised of independent directors; and

(ii) Certain specified companies that meet the criteria listed below are required to have atleast 2 (two) independent directors:

- Public companies which have paid up share capital of INR 100,000,000 (Rupees one hundred million only);

- Public companies which have a turnover of 1,000,000,000 (Rupees one billion only); and

- Public companies which have, in the aggregate, outstanding loans, debentures and deposits exceeding INR 500,000,000 (Rupees five hundred million only)

b) Qualification criteria:

(i) CA 2013 prescribes detailed qualifications for the appointment of an independent director on the board of a company. Some important qualifications include:

- he / she should be a person of integrity, relevant expertise and experience;

- he / she is not or was not a promoter of, or related to the promoter or director of the company or its holding, subsidiary or associate company;

- he / she has or had no pecuniary relationship with the company, its holding, subsidiary or associate company, or their promoters, or directors during the 2 (two) immediately preceding financial years or during the current financial year;

- a person, none of whose relatives have or had pecuniary relationship or transaction with the company, its holding, subsidiary or associate company, or their promoters, or directors amounting to 2 (two) percent or more of its gross turnover or total income or INR 5,000,000 (Rupees five million only), whichever is lower, during the 2 (two) immediately preceding financial years or during the current financial year.

(ii) CA 2013 also sets forth stringent provisions with respect to the relatives of the independent director.

|

Key Takeaways: It is evident from provisions of CA 2013 that much emphasis has been placed on ensuring greater independence of independent directors. The overall intent behind these provisions is to ensure that an independent director has no pecuniary relationship with, nor is he provided any incentives (other than the sitting fee for board meetings) by it in any manner, which may compromise his / her independence. In view of the additional criteria prescribed in CA 2013, many listed companies may need to revisit the criteria used in appointing their independent directors. |

Observations: CA 2013 proposes to significantly escalate the independence requirements of independent directors, when compared to the Listing Agreement:

- The CA 2013 requires an independent director to be a person of integrity, relevant expertise and experience; it fails to elaborate on the requisite standards for determining whether a person meets such criteria. Companies (acting through their respective nomination and remuneration committees) would be able to exercise their own judgment in the appointment of independent directors, diluting the “independence” criteria.

- While the Listing Agreement provided that an independent director must not have any material pecuniary relationship or transaction with the company, CA 2013 states that an independent director must not have had any pecuniary relationship with the company. Further, the Listing Agreement stipulated earlier that an independent director should not have had such transactions with the company, its holding company etc., at the time of appointment as an independent director, while CA 2013 extends this restriction to the current financial year or the immediately preceding two financial years. However, this provision in the Listing Agreement has been aligned with the CA 2013 by means of the circular issued by the Securities and Exchange Board of India (“SEBI”) dated April 17, 2014 titled Corporate Governance in Listed Entities- Amendments to Clauses 35B and 49 of the Equity Listing Agreement (“SEBI Circular”)1. The SEBI Circular has brought the provisions of the Listing Agreement in line with the provisions of CA 2013, and would be applicable from October 01, 2014. Further, the disqualification arising from any pecuniary relationship in the previous 2 (two) financial years under CA 2013 may be unreasonably restrictive, as there may be situations where a pecuniary transaction of the proposed independent director may safely be considered to be of a nature which does not affect the director’s independence, for instance, a person proposed to be appointed as an independent director may be the promoter or director of a supplier (or a counter-party to an arm’s length transaction) which has in the past (either during or for a period prior to the two immediately preceding financial years) been selected by the company through an independent tender process.

c) Duties of independent directors: Neither the Listing Agreement nor the CA 1956 prescribed the scope of duties of independent directors. CA 2013 includes a guide to professional conduct for independent directors, which crystallizes the role of independent directors by prescribing facilitative roles, such as offering independent judgment on issues of strategy, performance and key appointments, and taking an objective view on performance evaluation of the board. Independent directors are additionally required to satisfy themselves on the integrity of financial information, to balance the conflicting interests of all stakeholders and, in particular, to protect the rights of the minority shareholders. The SEBI Circular however, states that the board is required to lay down a code of conduct which would incorporate the duties of independent directors as set out in CA 2013.

|

Key Takeaways: CA 2013 imposes significantly onerous duties on independent directors, with a view to ensuring enhanced management and administration. While a list of specific duties has been introduced under CA 2013, it should by no means be considered to be exhaustive. Independent directors are unlikely to be exempt from liability merely because they have fulfilled the duties specified in CA 2013, and should be prudent and carry out all duties required for effective functioning of the company. |

d) Liability of independent directors

Under CA 1956, independent directors were not considered to be “officers in default” and consequently were not liable for the actions of the board. CA 2013 however, provides that the liability of independent directors would be limited to acts of omission or commission by a company which occurred with their knowledge, attributable through board processes, and with their consent and connivance or where they have not acted diligently.

|

Key Takeaways: CA 2013 proposes to empower independent directors with a view to increase accountability and transparency. Further, it seeks to hold independent directors liable for acts or omissions or commission by a company that occurred with their knowledge and attributable through board processes. While CA 2013 introduces these provisions with a view of increase accountability in the board this may discourage a lot of persons who could potentially have been appointed as independent directors from accepting such a position as they would be exposed to greater liabilities while having very limited control over the board. |

e) Position of Nominee Directors

- While the Listing Agreement stated that the nominee directors appointed by an institution that has invested in or lent to the company are deemed to be independent directors, CA 2013 states that a nominee director cannot be an independent director. However, the SEBI Circular in line with the provisions of CA 2013 has excluded nominee directors from being considered as independent directors.

- CA 2013 defines nominee director as a director nominated by any financial institution in pursuance of the provisions of any law for the time being in force, or of any agreement, or appointed by the Government or any other person to represent its interests.

|

Key Takeaways: The concept of independent director was introduced as part of the CA 2013 with a view to bring in independent judgement on the board. A director, once appointed, has to serve the interest of the shareholders as a whole. Directors appointed by private equity investors shall also be covered under the definition of nominee directors, and would no longer be eligible for appointment as independent directors. |

- Listed companies and certain other public companies shall be required to appoint atleast 1 (one) woman director on its board.

- Companies incorporated under CA 2013 shall be required to comply with this provision within 6 (six) months from date of incorporation. In case of companies incorporated under CA 1956, companies are required to comply with the provision within a period of 1 (one) year from the commencement of the act.

|

Key Takeaway: While the mandatory requirement for appointment of women directors is expected to bring diversity on to the boards, companies may find it difficult to be in compliance with CA 2013 unless they have already identified or internally groomed women candidates that are qualified to be appointed to the board. |

Duties of directors

CA 1956 did not contain any provisions that specifically identified the duties of directors. CA 2013 has set out the following duties of directors:

- To act in accordance with company’s articles;

- To act in good faith to promote the objects of the company for benefit of the members as a whole, and the best interest of the company, its employees, shareholders, community and for protection of the environment;

- Exercise duties with reasonable care, skill and diligence, and exercise of independent judgment;

The director is not permitted to:

- Be involved in a situation in which he may have direct or indirect interest that conflicts, or may conflict, with the interest of the company;

- Achieve or attempt to achieve any undue gain or advantage, either to himself or his relatives, partners or associates.

|

Key Takeaways: CA 2013 seeks to bring about greater standards of corporate governance, by imposing higher duties and liabilities for directors. While the act sets out specific duties, it does not clarify whether the duties of directors listed therein are exhaustive. Therefore, it would be prudent for directors to comply with all duties required for the effective functioning of the company and not be merely be directed by the specified duties which are at best very broadly phrased principles that should guide their behavior. Further, every director should take care to ensure that it acts in the best interested of all the shareholders as a whole. These provisions become particularly significant in case of nominee directors appointed by private equity investors, who have been known to represent the interests of the investors appointing them in direct contravention of their duties to the shareholders as a whole. |

II. COMMITTEES OF THE BOARD

CA 2013 envisages 4 (four) types of committees to be constituted by the board:

a) AUDIT COMMITTEE: Under CA 1956, public companies with a paid up capital in excess of INR 50,000,000 (Rupees fifty million only) were required to set up an audit committee comprising of not less than 3 (three) directors. Atleast one third had to be comprised of directors other than Managing Directors or Whole Time Directors. CA 2013 however, requires the board of every listed company and certain other public companies to constitute the audit committee consisting of a minimum of 3 (three) directors, with the independent directors forming a majority. It prescribes that a majority of members, including its Chairman, have to be persons with the ability to read and understand financial statements. The audit committee has been entrusted with the task of providing recommendations for appointment and remuneration of auditors, review of independence of auditors, providing approval of related party transactions and scrutiny over other financial mechanisms of the company.

b) NOMINATION AND REMUNERATION COMMITTEE: While CA 1956 did not require companies to set up nomination and remuneration committee, the Listing Agreement provided companies with the option to constitute a remuneration committee. However, CA 2013 requires the board of every listed company to constitute the Nomination and Remuneration Committee consisting of 3 (three) or more non-executive directors out of which not less than one half are required to be independent directors. The committee has the task of identifying persons who are qualified to become directors and provide recommendations to the board regarding their appointment and removal, as well as carry out their performance evaluation.

c) STAKEHOLDERS RELATIONSHIP COMMITTEE: CA 1956 did not require a company to set up a stakeholder’s relationship committee. The Listing Agreement required listed companies to set up a shareholders / investors grievance committee to examine complaints and issues of shareholders. CA 2013 requires every company having more than 1000 (one thousand) shareholders, debenture holders, deposit holders and any other security holders at any time during a financial year to constitute a stakeholders relationship committee to resolve the grievances of security holders of the company.

d) CORPORATE SOCIAL RESPONSIBILITY COMMITTEE (“CSR Committee”): CA 1956 did not impose any requirement on companies relating to corporate social responsibility (“CSR”). CA 2013 however, requires certain companies to constitute a CSR Committee, which would be responsible to devise, recommend and monitor CSR initiatives of the company. The committee is also required to prepare a report detailing the CSR activities undertaken and if not, the reasons for failure to comply.

|

Key Takeaways: CA 2013 sets out an advanced framework for board functioning by division of core board functions and their delegation to committees of the board. While the audit committee and the nomination and remuneration committee provide the back end infrastructure for boards, the stakeholder’s relationship committee and CSR Committee have been entrusted with the task of interaction with key stakeholders. Irrespective of their function, each of the committees would act as a “check and balance” on the powers of the board, by ensuring greater transparency and accountability in its functioning. |

III. BOARD MEETINGS AND PROCESSES

The key changes introduced by CA 2013 with respect to board meetings and processes are as under:

- First board meeting of a company to be held within 30 (thirty) days of incorporation;

- Notice of minimum 7 (seven) days must be given for each board meeting. Notice for board meetings may be given by electronic means. However, board meetings may be called at shorter notice to transact “urgent business” provided such meetings are either attended by at least 1 (one) independent director or decisions taken at such meetings on subsequent circulation are ratified by at least 1 (one) independent director.

- CA 2013 has permitted directors to participate in board meetings through video conferencing or other audio visual means which are capable of recording and recognising the participation of directors. Participation of directors by audio visual means would also be counted towards quorum.

- Requirement for holding board meeting every quarter has been discontinued. Now at least 4 (four) meetings have to be held each year, with a gap of not more than 120 (one hundred and twenty) days between 2 (two) board meetings.

- Certain new actions have been identified, that require approval by directors in a board meeting. These include issuance of securities, grant of loans, guarantee or security, approval of financial statement and board’s report, diversification of business etc.

- Approval of circular resolution will be by a majority of directors or members who are entitled to vote on the resolution, irrespective of whether they are present in India or otherwise.

|

Key Takeaways: In the backdrop of global corporate transactions, the changes relating to participation of directors by audio visual and electronic means are a welcome step, aimed at keeping pace with technological advancements. |

CONCLUSION

CA 2013 has introduced significant changes regarding the board composition and has a renewed focus on board processes. Whilst certain of these changes may seem overly prescriptive, a closer analysis leads to a compelling conclusion that the emphasis is on board processes, which over a period of time would institutionalize good corporate governance and not make governance over-dependent on the presence of certain individuals on the board.

You can direct your queries or comments to the authors

1 http://www.sebi.gov.in/cms/sebi_data/attachdocs/1397734478112.pdf

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |