Technology & Tax SeriesFebruary 04, 2021 Technology & Tax Series – Issue VII: Equalisation Levy Expansion 2021 – How Does it Affect Marketplaces and Online platforms?The infamous amendment by the Finance Act, 2020 expanded the scope of Equalization Levy (“EL”) to apply EL on the amount of ‘consideration received or receivable’ by an e-commerce operator from e-commerce supply or services made or provided or facilitated by or through it to specified persons (“Expanded EL”).

The Memorandum to the Finance Bill, 2021 (“Finance Bill”) notes that the Government felt the need to provide certain clarifications to correctly reflect the intention of certain provisions of the Expanded EL. The changes have brought with them further questions and potentially unintended consequences (several of which we have highlighted in our budget hotline accessible here). However, there are further doubts now regarding whether the scope of the Expanded EL is large enough to cover situations where even a communications platform or a payment aggregator could be covered within its scope, even though no commission is earned by it. For example, if a non-resident platform enables users to message each other and two parties agree to sell a tangible good, would such platform be required to deduct EL at 2% even though it provides free services to the users, may not even be aware of the transaction happening and in any case is not responsible in any ways for collecting or settling payments between the users. In this hotline, we discuss the impact of the definition of ‘consideration received or receivable from e-commerce supply or services’ proposed under the Finance Bill and the potential impact on different digital business models. We also seek to highlight the numerous problems and practical challenges in going down this path. We take a plain vanilla example which was what the amendment sought to presumably address and then we analyse possible unintended consequences. AMENDMENT BY FINANCE BILLThe term ‘consideration received or receivable’ was not defined under the provisions of Expanded EL as introduced by the Finance Act, 2020. In case of marketplace e-commerce operators, whereby the e-commerce operator is merely facilitating the sale of goods or provision of service between the seller and buyer on its platform in lieu of commission from the registered seller or buyer or both, it was unclear whether the Expanded EL would apply on the entire consideration of the transaction or only on the commission earned by the e-commerce operator. It appears that in this context the Finance Bill has proposed to define the term ‘consideration received or receivable from e-commerce supply or services’. The Finance Bill proposes to define the scope of ‘consideration received or receivable from e-commerce supply or services’ to include the below:

This has the potential to have a significant impact on marketplaces operated by the e-commerce operators since the Expanded EL is now likely to apply on the total value of the sale of goods or provision of services facilitated by them as opposed to being charged only on any commission earned by the platform. This is likely to create cash flow issues for the e-commerce operators. Further, it is unclear whether Expanded EL will be applicable in situations wherein marketplaces facilitate sale of goods or provision of service without charging any commission from either the buyer or seller. UNINTENDED CONSEQUENCES OF EL PROVISIONS OR JUST AN OVERBROAD PROVISION?The provisions of EL are contained in Chapter VIII (containing Section 163 to Section 180) of the Finance Act, 2016 (“FA, 2016”), as a separate, self-contained code, not forming part of the Income-tax Act, 1961 (“ITA”). Section 163 of the FA, 2016 provides that provisions of Chapter VIII shall inter-alia apply to consideration received or receivable for e-commerce supply or services made or provided or facilitated on or after April 1, 2020. In contrast, the charging provision, Section 165A of the FA, 2016 provides that Expanded EL shall apply on the amount of consideration received or receivable by an e-commerce operator from e-commerce supply or services. Therefore, it appears that the extent and applicability of Expanded EL (as provided under Section 163) is narrower and is limited to consideration received for e-commerce supply or services rather than consideration received from e-commerce supply or services (as contained in the charging Section 165A). The difference in language used and therefore the scope of the provisions can be explained better through an example. In a situation where a 3rd party seller sells a good over a platform for INR 100 and the commission of the platform operator is INR 5, the consideration received for an ecommerce service provided or facilitated by the platform operator should be INR 5. The consideration received by the e-commerce operator, assuming that they are responsible for handling the payment settlement, from the e-commerce supply facilitated by them should be INR 100. However, as set out above, the EL chapter applies only to consideration received for e-commerce supply and not from e-commerce supplies. To that extent the charging provision and the deeming fiction are broader than the scope of the EL chapter itself. Therefore, to that extent the charging provision is arguably inapplicable. CASE STUDIESWe have examined the potential implications of the proposed definition of ‘consideration received or receivable’ on the basis of the following case studies to further illustrate the impact:

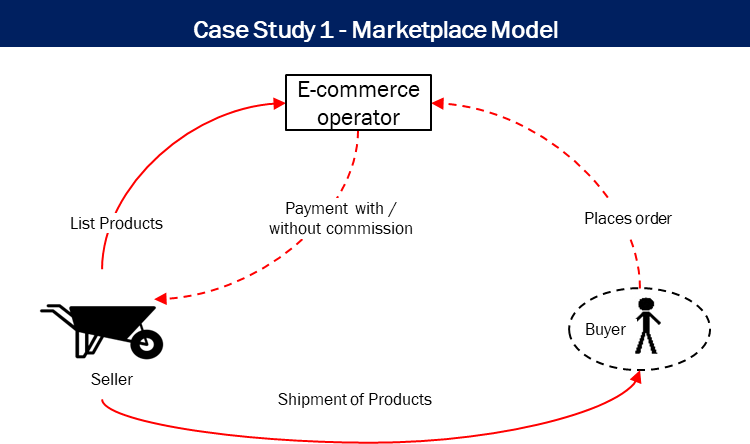

In case study 1, the e-commerce operator is facilitating supply of goods between the buyer and seller. The payment mechanics of the transaction and applicability of Expanded EL are elaborated below:

This is a significant issue since the whole objective of EL was to target the incomes of non-resident platforms which were going untaxed in India. In the above situation, there is no income of the platform to be taxed in the first place. To further, impose the burden of effectively paying taxes on behalf of the seller of the goods, is unreasonable and absurd. This becomes even more pronounced when we take the case of a communication platform as set out below.

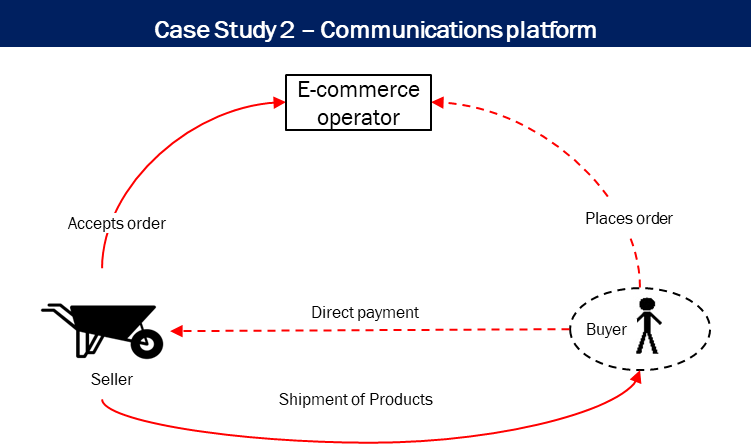

In case study 2, the e-commerce operator is primarily a communications platform and not a marketplace which is set up primarily to encourage and facilitate sales on its platform. The buyer connects with the seller through the communications platform (which can either be through messaging, email or directly through the portal). The buyer places order for the products through the communications platform. In such a situation, let us assume that two users message each other with respect to a transaction and the payment is made directly by the buyer to the seller through a 3rd party payment service provider which is outside the communications platform. Prior to the proposed amendment by the Finance Bill, it was possible to argue that the communications platform was not liable to pay Expanded EL as there is no consideration for e-commerce supply or services. However, post the amendment by Finance Bill, it is unclear whether Expanded EL would apply despite the fact that the communications platform does not receive any consideration. This is because the language used in the explanation states as follows: “consideration received or receivable from ecommerce supply or services shall include –

It is important to note that the deeming fiction firstly relates to consideration received from and not for supply or facilitation of ecommerce supply. Secondly, the deeming fiction states that the term “consideration received” shall include the value of the underlying sale or service that is facilitated. The intent is clear when the marketplace is charging INR 5 and the underlying supply is INR 95 since in such a case the EL may be payable on INR 100. However, with respect to the term “consideration received”, in the total absence of consideration in the above example, it may be possible to argue that the communication platform may not be liable to pay Expanded EL since there is no consideration received in the first place. This is particularly true in situations where the payment is not processed or settled by the platform and is instead done by a third party payment service provider. Nevertheless, since the deeming fiction appears to extend to the term “consideration received” and deems it to include the value of the underlying service or sale, it is possible that tax authorities take the view that even in situations where no money is paid to or passes through the platform, EL at 2% needs to be deducted. Such a situation would be particularly unfair to such platforms since they may not even be aware that a transaction took place or what the value of the transaction is or have any ability to collect and pay the EL. Ultimately, any such imposition would be a tax on the sellers income and not the platform’s and therefore the platform should not be saddled with any such burden. Further, it is trite law that the law does not compel a man to do what he cannot possibly perform.1 In this regard, Courts have also held that the law of impossibility of performance does not necessarily require absolute impossibility, but also encompasses the concept of severe impracticability.2 Given that the buyer makes the payment to the seller directly and no consideration flows through the communications platform, one could argue that Expanded EL should not be applicable. Having said this, given the construct of the EL provisions and the broad manner in which the proposed definition of consideration received or receivable is worded, it may be possible that the tax authorities argue that the communications platform is liable to pay Expanded EL on the value of the underlying transaction. Given the magnitude of the proposals, it is imperative that necessary changes are made to avoid unintended consequences and reduce unnecessary hardship. – Arijit Ghosh, Ipsita Agarwalla, Meyyappan Nagappan & Parul Jain You can direct your queries or comments to the authors 1 Krishnaswamy S. Pd. v. Union of India [2006] 281 ITR 305 2 National Aviation Co of India v. Deputy Commissioner of Income-tax, TDS ITA No. 6698 (Mum) of 2002 DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

The Memorandum to the Finance Bill, 2021 (“Finance Bill”) notes that the Government felt the need to provide certain clarifications to correctly reflect the intention of certain provisions of the Expanded EL. The changes have brought with them further questions and potentially unintended consequences (several of which we have highlighted in our budget hotline accessible here).

However, there are further doubts now regarding whether the scope of the Expanded EL is large enough to cover situations where even a communications platform or a payment aggregator could be covered within its scope, even though no commission is earned by it. For example, if a non-resident platform enables users to message each other and two parties agree to sell a tangible good, would such platform be required to deduct EL at 2% even though it provides free services to the users, may not even be aware of the transaction happening and in any case is not responsible in any ways for collecting or settling payments between the users.

In this hotline, we discuss the impact of the definition of ‘consideration received or receivable from e-commerce supply or services’ proposed under the Finance Bill and the potential impact on different digital business models. We also seek to highlight the numerous problems and practical challenges in going down this path. We take a plain vanilla example which was what the amendment sought to presumably address and then we analyse possible unintended consequences.

AMENDMENT BY FINANCE BILLThe term ‘consideration received or receivable’ was not defined under the provisions of Expanded EL as introduced by the Finance Act, 2020. In case of marketplace e-commerce operators, whereby the e-commerce operator is merely facilitating the sale of goods or provision of service between the seller and buyer on its platform in lieu of commission from the registered seller or buyer or both, it was unclear whether the Expanded EL would apply on the entire consideration of the transaction or only on the commission earned by the e-commerce operator. It appears that in this context the Finance Bill has proposed to define the term ‘consideration received or receivable from e-commerce supply or services’.

The Finance Bill proposes to define the scope of ‘consideration received or receivable from e-commerce supply or services’ to include the below:

- consideration for sale of goods irrespective of whether the e-commerce operator owns the goods;

- consideration for provision of services irrespective of whether service is provided or facilitated by the e-commerce operator.

This has the potential to have a significant impact on marketplaces operated by the e-commerce operators since the Expanded EL is now likely to apply on the total value of the sale of goods or provision of services facilitated by them as opposed to being charged only on any commission earned by the platform. This is likely to create cash flow issues for the e-commerce operators. Further, it is unclear whether Expanded EL will be applicable in situations wherein marketplaces facilitate sale of goods or provision of service without charging any commission from either the buyer or seller.

UNINTENDED CONSEQUENCES OF EL PROVISIONS OR JUST AN OVERBROAD PROVISION?The provisions of EL are contained in Chapter VIII (containing Section 163 to Section 180) of the Finance Act, 2016 (“FA, 2016”), as a separate, self-contained code, not forming part of the Income-tax Act, 1961 (“ITA”). Section 163 of the FA, 2016 provides that provisions of Chapter VIII shall inter-alia apply to consideration received or receivable for e-commerce supply or services made or provided or facilitated on or after April 1, 2020. In contrast, the charging provision, Section 165A of the FA, 2016 provides that Expanded EL shall apply on the amount of consideration received or receivable by an e-commerce operator from e-commerce supply or services. Therefore, it appears that the extent and applicability of Expanded EL (as provided under Section 163) is narrower and is limited to consideration received for e-commerce supply or services rather than consideration received from e-commerce supply or services (as contained in the charging Section 165A).

The difference in language used and therefore the scope of the provisions can be explained better through an example. In a situation where a 3rd party seller sells a good over a platform for INR 100 and the commission of the platform operator is INR 5, the consideration received for an ecommerce service provided or facilitated by the platform operator should be INR 5. The consideration received by the e-commerce operator, assuming that they are responsible for handling the payment settlement, from the e-commerce supply facilitated by them should be INR 100. However, as set out above, the EL chapter applies only to consideration received for e-commerce supply and not from e-commerce supplies. To that extent the charging provision and the deeming fiction are broader than the scope of the EL chapter itself. Therefore, to that extent the charging provision is arguably inapplicable.

CASE STUDIESWe have examined the potential implications of the proposed definition of ‘consideration received or receivable’ on the basis of the following case studies to further illustrate the impact:

In case study 1, the e-commerce operator is facilitating supply of goods between the buyer and seller. The payment mechanics of the transaction and applicability of Expanded EL are elaborated below:

- E-commerce operator charging commission from buyer / seller or both: In this case, the buyer makes payment to the seller through the e-commerce operator. On receipt of payment (say INR 100), the e-commerce operator deducts its commission (say INR 5) and pays the remaining amount to the seller (INR 95). Prior to the proposed amendment by the Finance Bill, even on the wordings of Section 165A it was possible to argue that the e-commerce operator was liable to pay Expanded EL only on the amount of consideration (INR 5). However, post the amendment by Finance Bill, the e-commerce operator would be liable to pay Expanded EL on the entire consideration (INR 100) as the definition deems to include consideration for sale of goods irrespective of whether the e-commerce operator owns the goods.

- E-commerce operator not charging commission from buyer / seller or both: In this case, the buyer makes payment to the seller through the e-commerce operator. On receipt of payment for sale of goods, the e-commerce operator pays the entire amount to the seller (INR 95) without deducting any commission. Prior to the proposed amendment by the Finance Bill, it was possible to argue that the e-commerce operator was not liable to pay Expanded EL as there is no consideration for e-commerce supply or services. However, post the amendment by Finance Bill, the e-commerce operator may be liable to pay Expanded EL on the entire consideration (INR 95) as the definition deems the term ‘consideration received’ to include consideration for sale of goods irrespective of whether the e-commerce operator owns the goods. While the intention appears to have been to cover gross payments, the current reading of the provision (explained further below in the next example) potentially goes beyond that to cover situations where consideration is not received by the E-commerce operator at all.

This is a significant issue since the whole objective of EL was to target the incomes of non-resident platforms which were going untaxed in India. In the above situation, there is no income of the platform to be taxed in the first place. To further, impose the burden of effectively paying taxes on behalf of the seller of the goods, is unreasonable and absurd. This becomes even more pronounced when we take the case of a communication platform as set out below.

In case study 2, the e-commerce operator is primarily a communications platform and not a marketplace which is set up primarily to encourage and facilitate sales on its platform. The buyer connects with the seller through the communications platform (which can either be through messaging, email or directly through the portal). The buyer places order for the products through the communications platform.

In such a situation, let us assume that two users message each other with respect to a transaction and the payment is made directly by the buyer to the seller through a 3rd party payment service provider which is outside the communications platform. Prior to the proposed amendment by the Finance Bill, it was possible to argue that the communications platform was not liable to pay Expanded EL as there is no consideration for e-commerce supply or services. However, post the amendment by Finance Bill, it is unclear whether Expanded EL would apply despite the fact that the communications platform does not receive any consideration. This is because the language used in the explanation states as follows:

“consideration received or receivable from ecommerce supply or services shall include –

- consideration for sale of goods irrespective of whether the e-commerce operator owns the goods;

- consideration for provision of services irrespective of whether service is provided or facilitated by the e-commerce operator”

It is important to note that the deeming fiction firstly relates to consideration received from and not for supply or facilitation of ecommerce supply. Secondly, the deeming fiction states that the term “consideration received” shall include the value of the underlying sale or service that is facilitated. The intent is clear when the marketplace is charging INR 5 and the underlying supply is INR 95 since in such a case the EL may be payable on INR 100.

However, with respect to the term “consideration received”, in the total absence of consideration in the above example, it may be possible to argue that the communication platform may not be liable to pay Expanded EL since there is no consideration received in the first place. This is particularly true in situations where the payment is not processed or settled by the platform and is instead done by a third party payment service provider. Nevertheless, since the deeming fiction appears to extend to the term “consideration received” and deems it to include the value of the underlying service or sale, it is possible that tax authorities take the view that even in situations where no money is paid to or passes through the platform, EL at 2% needs to be deducted. Such a situation would be particularly unfair to such platforms since they may not even be aware that a transaction took place or what the value of the transaction is or have any ability to collect and pay the EL. Ultimately, any such imposition would be a tax on the sellers income and not the platform’s and therefore the platform should not be saddled with any such burden.

Further, it is trite law that the law does not compel a man to do what he cannot possibly perform.1 In this regard, Courts have also held that the law of impossibility of performance does not necessarily require absolute impossibility, but also encompasses the concept of severe impracticability.2 Given that the buyer makes the payment to the seller directly and no consideration flows through the communications platform, one could argue that Expanded EL should not be applicable.

Having said this, given the construct of the EL provisions and the broad manner in which the proposed definition of consideration received or receivable is worded, it may be possible that the tax authorities argue that the communications platform is liable to pay Expanded EL on the value of the underlying transaction. Given the magnitude of the proposals, it is imperative that necessary changes are made to avoid unintended consequences and reduce unnecessary hardship.

– Arijit Ghosh, Ipsita Agarwalla, Meyyappan Nagappan & Parul Jain

You can direct your queries or comments to the authors

1 Krishnaswamy S. Pd. v. Union of India [2006] 281 ITR 305

2 National Aviation Co of India v. Deputy Commissioner of Income-tax, TDS ITA No. 6698 (Mum) of 2002

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |