Investment Funds: Monthly DigestJanuary 31, 2024 Take II: Liquidation of AIFs and VCFs Operating Beyond Their TenureINTRODUCTIONThe financial landscape in India, particularly in the domain of Alternative Investment Funds (“AIFs”) and Venture Capital Funds (“VCFs”), has witnessed dynamic changes over the past few years necessitating regulatory adaptations. In this context, in mid-2023, the Securities and Exchange Board of India (“SEBI”) had amended the SEBI (Alternative Investment Funds) Regulations, 20121 (“AIF Regulations”) to establish a liquidation scheme framework. The objective of this framework was to offer AIFs and their investors flexibility to manage unliquidated investments beyond the expiry of the AIF’s tenure. For an in-depth analysis of the liquidation scheme framework, please refer to our monthly digest available here. Multiple operational issues were raised by the industry participants around the liquidation scheme framework. Some of the key issues include (i) launching a new scheme to carry over the unliquidated portfolio, leading to potential tax issues; (ii) non-availability to AIFs whose liquidation period has expired; and (iii) non-availability of the liquidation scheme framework to venture capital funds launched under the erstwhile SEBI (Venture Capital Funds) Regulations, 1996 (“VCF Regulations”). To address these issues, SEBI has now released a consultation paper on providing flexibility to AIFs, VCFs and their investors to deal with unliquidated investments of their schemes beyond expiry of tenure (the “Consultation Paper”).2 NEED FOR A NEW FRAMEWORKThe Consultation Paper contemplates allowing the same scheme of an AIF to continue beyond its tenure for a specified period, referred to as the “Dissolution Period/Process”, in case it has certain unliquidated portfolio at the end of its tenure. SEBI cautions against this flexibility being used to hamper the integrity of the AIF ecosystem, particularly by reducing visibility of true asset quality, liquidity, and performance. In particular, the Consultation Paper covers the following key aspects: 1) Dissolution Process under the same AIF Scheme for Unliquidated Investments The Consultation Paper proposes permitting schemes of AIFs to enter into a Dissolution Period to deal with their unliquidated portfolio upon the completion of the one-year liquidation period, as calculated from the date of expiry of their tenure (including any extensions).3 The timeline of an AIF according to the Consultation Paper is depicted below.

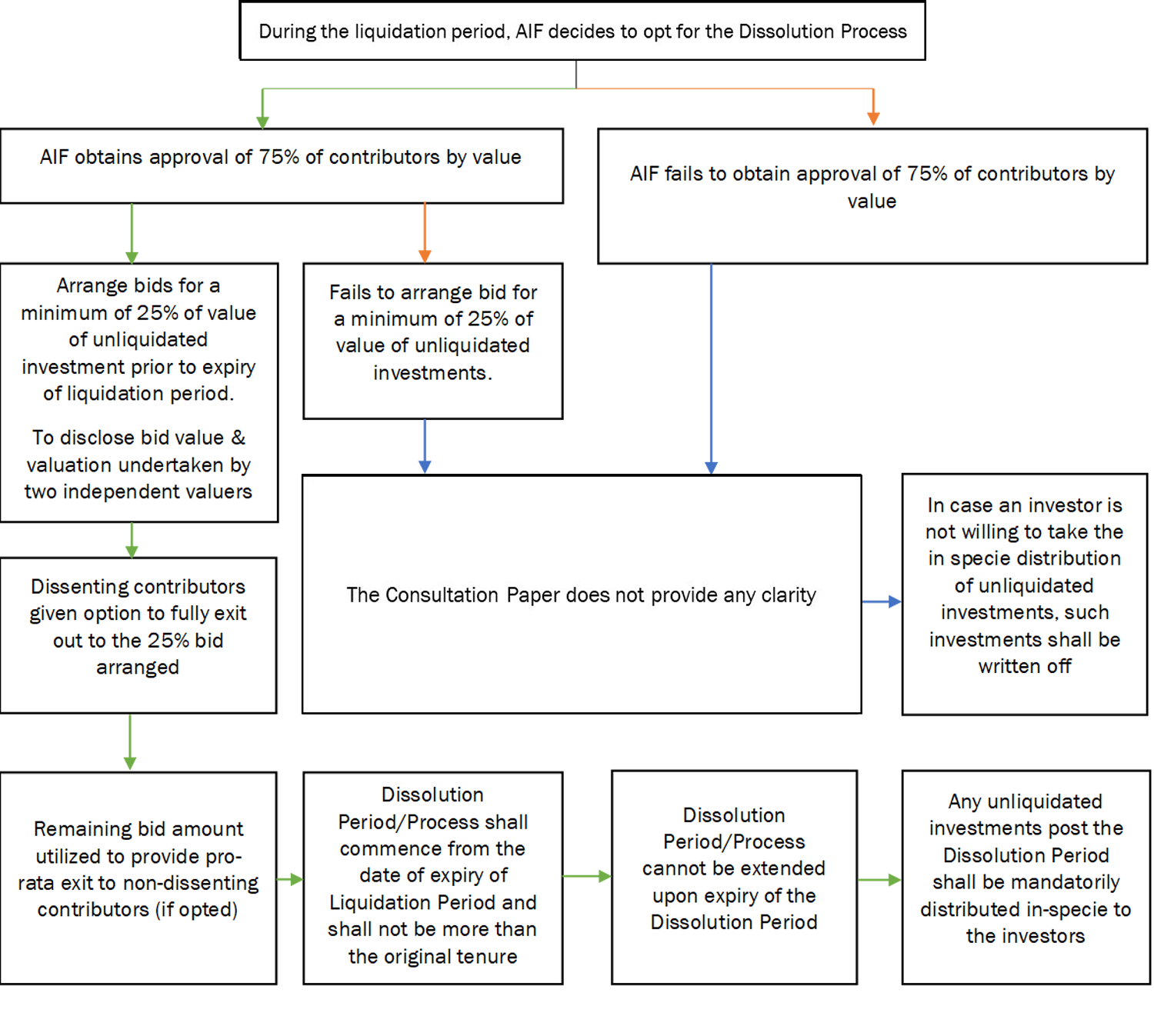

The proposed Dissolution Process is depicted in the flowchart below. In certain circumstances, the next course of action for the AIF / its manager is unclear in respect of the portfolio remaining unliquidated at the end of its tenure.

Impact on the Manager:The performance benchmarking and track record of the AIF manager will get impacted if it goes into Dissolution Process (including inability to quote the performance in future marketing efforts). The AIF Manager is also not permitted to charge fee during the Dissolution Period. Impact on the Investors: In the circumstances mentioned in the flow chart above, there may be compulsory in-specie distribution to investors. It is uncertain how this may be enforced against investors. There could also be legal issues in imposing such an in-specie distributions compulsorily on investors. For example, while the AIF could have held non-convertible debentures, it may not be possible for foreign investors to hold the same without getting necessary registrations in place with SEBI. 2) Flexibility for AIF Schemes with Expired Tenure The Consultation Paper proposes to give a fresh one-time liquidation period to AIFs (i) whose liquidation period has expired before the amendment to the AIF Regulations on June 15, 2023; and (ii) do not have any pending investor complaint with respect to non-receipt of funds/investments. The one-time Liquidation Period, if granted, would span one year and commence from the date of notification of the amendment to the AIF Regulations specifically addressing this provision. During this extended Liquidation Period, the AIFs in question will have the following options:

Several AIFs struggled with an unliquidated portfolio after the pandemic, and in the absence of any existing framework or the potential for any framework to deal with the same, had to write-off the portfolio as there was no market for receiving in-specie distributions or even a fire sale. 3) Bringing VCFs Under the AIF Regime SEBI, in response to the industry’s call for attention to the plight of VCFs, specifically with respect to liquidation (given most VCFs are well beyond their respective tenures), has sought to provide VCFs with the best of both worlds under the VCF Regulations and the AIF Regulations. Particularly, SEBI has proposed the following with respect to migration of VCFs:

ANALYSIS & CONCLUSIONSEBI has made a significant effort to respond to industry stakeholders' concerns following the initial proposal on AIF liquidation. However, confusion persists regarding some of the proposals outlined in the Consultation Paper. Primarily, certain steps in the Dissolution Process seem incomplete to the extent that they do not see the alternative options through to the end. For instance, SEBI has not provided for the next steps in case the investment manager fails to arrange bids at the very outset of the Dissolution Process. Similarly, under the current Consultation Paper, there is little clarity on the consequences of the failure of such mandatory in-specie distribution where the extant provisions pertaining to the liquidation scheme expressly states that such unliquidated investments are to be written off by the investment manager. The Consultation Paper does not account for investors, particularly institutional investors (due to their internal policies), who may not want to receive in-specie distributions. Moreover, given the lack of a secondary market in the foreseeable future for most assets held by AIFs, investors at large may not prefer in-specie distributions. Rather, they may prefer to have the investment manager continue to manage the asset, as well as continue to add value to the portfolio entities in terms of operational oversight and advice. Furthermore, the present construct envisioned under the Consultation Paper may be impractical as the investment manager might be unable to obligate investors to receive in-specie distributions. In such a scenario, the investment manager would be non-compliant with the present construct if it is unable to obtain a 75% investor consent for either dissolution process or in-specie distribution with no way of remedying such non-compliance. Additionally, SEBI’s proposal to not allow management fee to be charged during the Dissolution Period does not take into account that the investment manager will still be required to undertake substantial efforts in managing and divesting the unliquidated investments, deal with bankers, pay salaries to its employees and undertake all such activities as may be necessary to liquidate the investments. Further, investment managers may be required to undertake certain compliance requirements such as the quarterly reporting and submission of compliance test reports during the dissolution period.8 More importantly, AIF investors are sophisticated investors who ought to be provided the flexibility to determine the rate and charging of management fee. Moreover, the requirement to not report to performance benchmarking agencies once the AIF has entered into the Dissolution Period further disincentivises investment managers from securing the best exit possible for unliquidated investments. It should be noted that the recent uptick in the quantum of unliquidated investments is largely attributable to the Covid-19 pandemic. Investment managers should not be penalized for such unprecedented events. A more practical approach would have been to bar track record attribution for only those investments which were liquidated during the Dissolution Period. The proposal of providing a one-time flexibility to AIFs whose liquidation period ended prior to June 15, 2023 is a welcoming recommendation given that this is aimed at providing such AIFs with a structured and time-bound approach to address unliquidated investments. The various proposals under the Consultation Paper seek to address industry concerns while ensuring responsible and accountable management of unliquidated investments within the private funds ecosystem. As the tenure of some of India’s earliest AIFs (or their schemes) near (or have arrived at) the end of their tenures, the industry is hopeful of SEBI addressing the above-identified uncertainties surrounding the management of unliquidated investments at the time of notification of the amendments.

You can direct your queries or comments to the authors. 1SEBI (AIF) (Second Amendment) Regulations, 2023 dated June 15, 2023. 2Consultation paper on providing flexibility to AIFs, VCFs and their investors to deal with unliquidated investments of their schemes beyond expiry of tenure, Reports for public comments dated January 12, 2024. 3Proposal A of the Consultation Paper. 4with consent of 75% of its investors (by value). 5subject to consent of two-thirds of the unit holders (by value). 6Subject to no investor complaints pending with respect to non-receipt of funds/investments. 7Such fresh liquidation period to begin from the date of issuance of fresh certificate of registration as a Migrated VCF. 8Clause 15.2 of the Master Circular for Alternative Investment Funds.

DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

INTRODUCTION

The financial landscape in India, particularly in the domain of Alternative Investment Funds (“AIFs”) and Venture Capital Funds (“VCFs”), has witnessed dynamic changes over the past few years necessitating regulatory adaptations.

In this context, in mid-2023, the Securities and Exchange Board of India (“SEBI”) had amended the SEBI (Alternative Investment Funds) Regulations, 20121 (“AIF Regulations”) to establish a liquidation scheme framework. The objective of this framework was to offer AIFs and their investors flexibility to manage unliquidated investments beyond the expiry of the AIF’s tenure. For an in-depth analysis of the liquidation scheme framework, please refer to our monthly digest available here.

Multiple operational issues were raised by the industry participants around the liquidation scheme framework. Some of the key issues include (i) launching a new scheme to carry over the unliquidated portfolio, leading to potential tax issues; (ii) non-availability to AIFs whose liquidation period has expired; and (iii) non-availability of the liquidation scheme framework to venture capital funds launched under the erstwhile SEBI (Venture Capital Funds) Regulations, 1996 (“VCF Regulations”).

To address these issues, SEBI has now released a consultation paper on providing flexibility to AIFs, VCFs and their investors to deal with unliquidated investments of their schemes beyond expiry of tenure (the “Consultation Paper”).2

NEED FOR A NEW FRAMEWORK

The Consultation Paper contemplates allowing the same scheme of an AIF to continue beyond its tenure for a specified period, referred to as the “Dissolution Period/Process”, in case it has certain unliquidated portfolio at the end of its tenure.

SEBI cautions against this flexibility being used to hamper the integrity of the AIF ecosystem, particularly by reducing visibility of true asset quality, liquidity, and performance.

In particular, the Consultation Paper covers the following key aspects:

1) Dissolution Process under the same AIF Scheme for Unliquidated Investments

The Consultation Paper proposes permitting schemes of AIFs to enter into a Dissolution Period to deal with their unliquidated portfolio upon the completion of the one-year liquidation period, as calculated from the date of expiry of their tenure (including any extensions).3

The timeline of an AIF according to the Consultation Paper is depicted below.

The proposed Dissolution Process is depicted in the flowchart below. In certain circumstances, the next course of action for the AIF / its manager is unclear in respect of the portfolio remaining unliquidated at the end of its tenure.

Impact on the Manager:The performance benchmarking and track record of the AIF manager will get impacted if it goes into Dissolution Process (including inability to quote the performance in future marketing efforts). The AIF Manager is also not permitted to charge fee during the Dissolution Period.

Impact on the Investors: In the circumstances mentioned in the flow chart above, there may be compulsory in-specie distribution to investors. It is uncertain how this may be enforced against investors. There could also be legal issues in imposing such an in-specie distributions compulsorily on investors. For example, while the AIF could have held non-convertible debentures, it may not be possible for foreign investors to hold the same without getting necessary registrations in place with SEBI.

2) Flexibility for AIF Schemes with Expired Tenure

The Consultation Paper proposes to give a fresh one-time liquidation period to AIFs (i) whose liquidation period has expired before the amendment to the AIF Regulations on June 15, 2023; and (ii) do not have any pending investor complaint with respect to non-receipt of funds/investments.

The one-time Liquidation Period, if granted, would span one year and commence from the date of notification of the amendment to the AIF Regulations specifically addressing this provision.

During this extended Liquidation Period, the AIFs in question will have the following options:

-

Full Liquidation: The AIFs can opt to fully liquidate their investments.

-

In-specie Distribution: Alternatively, they may choose to distribute their investments in-specie to investors.

-

Dissolution Period/Process: A third option involves opting for the Dissolution Period/Process, as outlined in Proposal A.

Several AIFs struggled with an unliquidated portfolio after the pandemic, and in the absence of any existing framework or the potential for any framework to deal with the same, had to write-off the portfolio as there was no market for receiving in-specie distributions or even a fire sale.

3) Bringing VCFs Under the AIF Regime

SEBI, in response to the industry’s call for attention to the plight of VCFs, specifically with respect to liquidation (given most VCFs are well beyond their respective tenures), has sought to provide VCFs with the best of both worlds under the VCF Regulations and the AIF Regulations.

Particularly, SEBI has proposed the following with respect to migration of VCFs:

-

Smooth and cost-effective migration:

-

No application/registration/migration fees to be levied;

-

Submit original VCF registration certificate to SEBI to receive a fresh registration certificate as Category I AIF – (Migrated VCF); and

-

Not required to meet the eligibility criteria for AIFs (such as minimum sponsor commitment, minimum corpus, and minimum investment amount).

-

Availability of the Dissolution Period/Process proposed for AIFs – Migrated VCF may:

-

Sell its unliquidated investments;

-

Distribute such investments in-specie to the investors; or

-

Opt for the proposed Distribution Period/Process after obtaining approval of at least 75% of the investors of the scheme (by value).

-

-

Tenure, extension of tenure and liquidation:

-

Tenure of the Migrated VCF:

-

If tenure defined in the PPM - residual tenure under the PPM

-

If tenure not defined in the PPM – tenure to be defined by the VCF at the time of migration.4

-

Migrated VCFs may extend their tenure up to two years from the date of the tenure as defined in their PPM;5

-

Migrated VCFs whose tenure has/will expire within one month of the date of notification by SEBI6 to be given a fresh one-time liquidation period of one year;7 and

-

Migrated VCFs to fully liquidate their investments or enter into the proposed Dissolution Period / Process during this liquidation period.

-

-

Consequences of migration and non-migration:

-

VCFs whose liquidation period has not yet expired:

-

If choosing to migrate - will be given flexibility with respect to extension of tenure and the facility to opt for Dissolution Period / Process.

-

If choosing to not migrate – will be subject to additional reporting requirements similar to those under the AIF Regulations. Such VCFs will not be able to extend their tenure or opt for the Dissolution Period / Process.

-

-

VCFs operating beyond their liquidation period:

-

If choosing to migrate – may be regularized if they opt for Dissolution Period / Process.

-

If choosing to not migrate – shall be subject to appropriate regulatory action for continuing beyond the expiry of the original liquidation period, i.e., from the expiry of 3 months after the expiry of their tenure.

-

-

VCFs who have not commenced any investment activity from the date of their registration and VCFs who have wound up their schemes but have not yet surrendered their registration certificate:

-

Shall be deemed to be inactive and their certificate of registration shall be cancelled.

-

ANALYSIS & CONCLUSION

SEBI has made a significant effort to respond to industry stakeholders' concerns following the initial proposal on AIF liquidation. However, confusion persists regarding some of the proposals outlined in the Consultation Paper.

Primarily, certain steps in the Dissolution Process seem incomplete to the extent that they do not see the alternative options through to the end. For instance, SEBI has not provided for the next steps in case the investment manager fails to arrange bids at the very outset of the Dissolution Process. Similarly, under the current Consultation Paper, there is little clarity on the consequences of the failure of such mandatory in-specie distribution where the extant provisions pertaining to the liquidation scheme expressly states that such unliquidated investments are to be written off by the investment manager.

The Consultation Paper does not account for investors, particularly institutional investors (due to their internal policies), who may not want to receive in-specie distributions. Moreover, given the lack of a secondary market in the foreseeable future for most assets held by AIFs, investors at large may not prefer in-specie distributions. Rather, they may prefer to have the investment manager continue to manage the asset, as well as continue to add value to the portfolio entities in terms of operational oversight and advice.

Furthermore, the present construct envisioned under the Consultation Paper may be impractical as the investment manager might be unable to obligate investors to receive in-specie distributions. In such a scenario, the investment manager would be non-compliant with the present construct if it is unable to obtain a 75% investor consent for either dissolution process or in-specie distribution with no way of remedying such non-compliance.

Additionally, SEBI’s proposal to not allow management fee to be charged during the Dissolution Period does not take into account that the investment manager will still be required to undertake substantial efforts in managing and divesting the unliquidated investments, deal with bankers, pay salaries to its employees and undertake all such activities as may be necessary to liquidate the investments. Further, investment managers may be required to undertake certain compliance requirements such as the quarterly reporting and submission of compliance test reports during the dissolution period.8

More importantly, AIF investors are sophisticated investors who ought to be provided the flexibility to determine the rate and charging of management fee. Moreover, the requirement to not report to performance benchmarking agencies once the AIF has entered into the Dissolution Period further disincentivises investment managers from securing the best exit possible for unliquidated investments.

It should be noted that the recent uptick in the quantum of unliquidated investments is largely attributable to the Covid-19 pandemic. Investment managers should not be penalized for such unprecedented events. A more practical approach would have been to bar track record attribution for only those investments which were liquidated during the Dissolution Period.

The proposal of providing a one-time flexibility to AIFs whose liquidation period ended prior to June 15, 2023 is a welcoming recommendation given that this is aimed at providing such AIFs with a structured and time-bound approach to address unliquidated investments.

The various proposals under the Consultation Paper seek to address industry concerns while ensuring responsible and accountable management of unliquidated investments within the private funds ecosystem. As the tenure of some of India’s earliest AIFs (or their schemes) near (or have arrived at) the end of their tenures, the industry is hopeful of SEBI addressing the above-identified uncertainties surrounding the management of unliquidated investments at the time of notification of the amendments.

– Athul Kumar, Payal Saraogi, Dibya Behera and Nandini Pathak

You can direct your queries or comments to the authors.

1SEBI (AIF) (Second Amendment) Regulations, 2023 dated June 15, 2023.

2Consultation paper on providing flexibility to AIFs, VCFs and their investors to deal with unliquidated investments of their schemes beyond expiry of tenure, Reports for public comments dated January 12, 2024.

3Proposal A of the Consultation Paper.

4with consent of 75% of its investors (by value).

5subject to consent of two-thirds of the unit holders (by value).

6Subject to no investor complaints pending with respect to non-receipt of funds/investments.

7Such fresh liquidation period to begin from the date of issuance of fresh certificate of registration as a Migrated VCF.

8Clause 15.2 of the Master Circular for Alternative Investment Funds.

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |