Deal Talk

September 30, 2024

SEBI “Clears the Runway” For Spicejet: Promoters to Take Off Without Open Offer Turbulence

A. Introduction

Takeover of public

listed companies in India is governed under

the SEBI (Substantial Acquisition of Shares

and Takeover) Regulations, 2011 (‘Takeover

Code’). The Takeover Code provides

for the following triggers for an open offer

obligation on the acquirers and persons acting

in concert with such acquirers (‘PAC’):

Regulation 10 of the

Takeover Code provides for general exemptions

available to an acquirer and a PAC. While Regulation

10 provides specific types of events and / or

acquisitions which will be exempt from the requirement

of making an open offer, Regulation 11 also

provides the Indian securities market regulator

(i.e. the Securities and Exchange Board of India

(‘SEBI’)), the

power to exempt any transaction from an open

offer obligation, if SEBI believes that such

exemption is required in the interests of investors

in securities and the securities market. An acquirer and a PAC

can file an exemption with SEBI by providing

their rationale for seeking such exemptions.

Over the years, there have been a lot of precedents

for deal-making through the grant of such exemptions.

Recently, SEBI granted an exemption to the promoters

of SpiceJet Limited (‘SpiceJet’)

for conversion of their warrants into equity

shares of SpiceJet. This exemption is unique

given that the promoters of SpiceJet made a

strong case to SEBI that the open offer obligation

was onerous on the promoters and would be further

detrimental to the financial position of SpiceJet.

To prove their commitment to this position,

the promoters also agreed to discharge certain

additional obligations in case the exemption

were to be granted. In this Deal Talk,

we discuss this exemption from SEBI, and discuss

how a voluntary attempt to comply with spirit

of the law may be beneficial in structuring

deals and assisting with a regulatory approval

process (which, in this case, involved seeking

an exemption from SEBI with respect to the mandatory

open offer requirements under the Takeover Code).

B. Particulars of exemption sought

by the promoters of SpiceJet

In light of the 2019

Covid pandemic, the Indian government had announced

an Emergency Credit Line Guarantee Scheme (‘ECLGS’)

to provide financial support to Indian companies

in different sectors, which also included aviation.

Under the ECLGS, an airline was eligible for

a loan of up to INR 1,500 crores per borrower

(as part of which, up to INR 500 crores was

allowed only if there was proportionate equity

contribution by the promoters / owners of the

Company). As part of the ECLGS,

existing lenders of SpiceJet had previously

sanctioned credit facilities worth INR 200 crores,

and the promoters of SpiceJet were required

to also infuse proportionate equity capital

to avail disbursement of the credit facilities. In order to satisfy

the aforementioned criteria and to help SpiceJet

during its financial distress, SpiceJet Healthcare

Private Limited (‘SHPL’)

(a ‘promoter group entity’ as per

applicable SEBI regulations) infused INR 200

crores in SpiceJet as part equity and part warrant

transaction structured as below:

As per the SEBI (Issue

of Capital and Disclosure Requirements) Regulations,

in case of issuance of warrants by a listed

company, at least 25% of the consideration amount

based on the exercise price shall be paid upfront

and the remaining unpaid consideration shall

be paid at the time of exercise of the warrants.

Therefore, SHPL was statutorily obligated to

pay INR 294.09 crores to SpiceJet at the time

of exercise (which corresponds to balance 75%

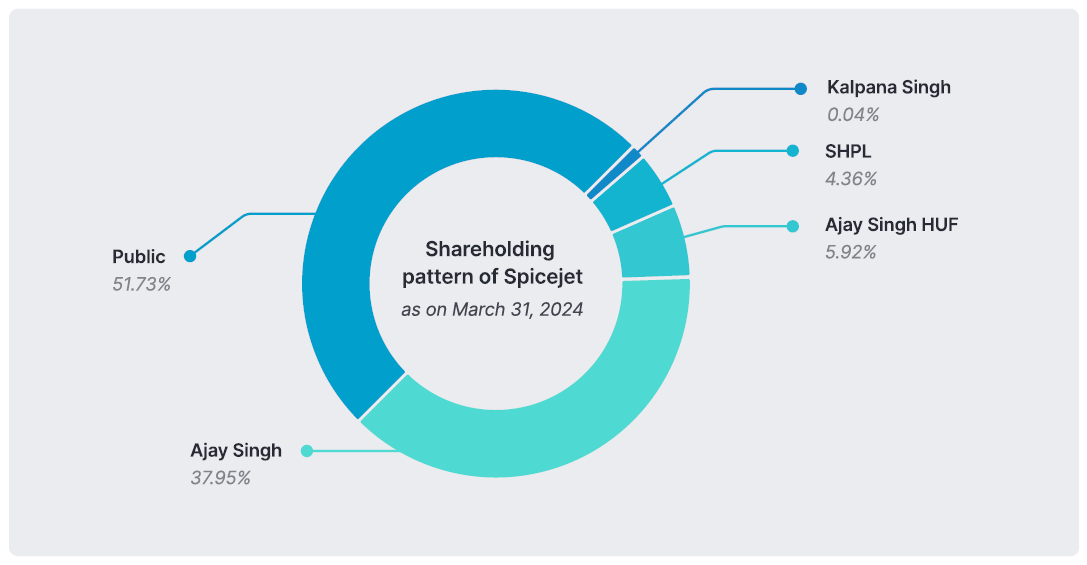

of the consideration amount for warrants). The other promoters

of SpiceJet would be considered as ‘persons

acting in concert’ with SHPL (as Mr. Ajay

Singh holds 50% shares of SHPL), and the total

shareholding of SHPL with its PAC would be more

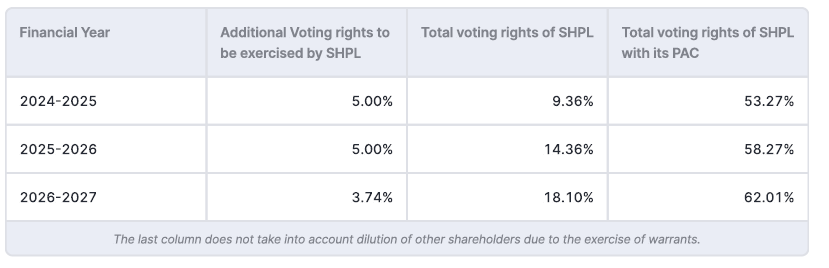

than 25%. Therefore, SHPL and the other promoters

of SpiceJet could only acquire 5% additional

shares of SpiceJet in any financial year to

avoid triggering an open offer due to the occurrence

of a creeping acquisition (i.e. an acquisition

of up to 5% shareholding that is permissible

for a person holding 25% shareholding of a public

listed company, with any increases beyond this

threshold being subject to a mandatory open

offer under the Takeover Code). Given that the

warrants upon exercise would entitle SHPL to

13.74%, the exercise of the warrants would trigger

a creeping acquisition. SHPL requested SEBI

for an exemption from the obligation to undertake

an open offer. The grounds provided by SHPL

for this exemption request were as follows:

C. SEBI’s position with

respect to the exemption

D. Does this mean that others

can also claim a similar exemption from the

open offer requirement under the Takeover Code?

While previous exemptions

granted by SEBI under the Takeover Code have

precedential value, not all grounds raised by

SHPL were something which provided comfort to

SEBI. The open offer being a paper exercise

due to no actual change in control or being

an additional cost to the acquirer would, in

all probabilities, not be considered as valid

grounds for seeking an exemption from the open

offer requirement. The factors that would

have perhaps given most comfort to SEBI (which

is also reflected in observations by SEBI) were:

(a) the fact that SHPL had invested into SpiceJet

to ensure eligibility under the ECLGS in order

to assist the company during financial distress;

(b) the self-imposition of an additional lock-in

(over and above the period contemplated within

the law); and (c) restriction of the exercise

of voting rights to 5% in every financial year

(in order to ensure compliance with applicable

law). This helped SHPL convince SEBI that their

intention was always to help SpiceJet, and therefore

this exemption would be in the interests of

investors in securities and the securities market. While it would be interesting

to see if SEBI continues to provide similar

exemptions based on self-imposition of restrictions,

solely self-imposition would not ideally entitle

an acquirer for an exemption. A key factor in

this case was the financial distress being faced

by SpiceJet. There have been multiple precedents

of SEBI providing exemption from open offer

to the investors in cases where the target company

is going through financial distress and resolving

the financial distress specifically required

promoter fund infusion as per the ECLGS scheme.

Neither of these reasons in silo would have

helped the promoters of SpiceJet. For instance,

in the exemption order for acquisition of Lyka

Labs Limited (2016), the promoters claimed that

the target company was in financial distress

and their subscription to the warrants was for

resolving the financial distress and therefore,

they were seeking an exemption from open offer

upon conversion of such warrants. One of the

key reasons why SEBI denied the exemption was

that while the company was in financial distress,

the banks did not stipulate that promoter infusion

was a condition precedent to the banks providing

further funds. The banks in their letter had

only communicated that the company is facing

a liquidity crunch, and it was advisable that

the company should infuse fresh capital or increase

their net worth to improve their financial ratio.

SEBI was of the view that this was in no nature

a stipulation and therefore did not grant an

exemption. So, the fact that as part of ECLGS,

promoter infusion was a stipulation was also

a key consideration for SEBI. Additionally,

in the same order (and other precedents as well)

SEBI has held that additional cost to the promoter

or financial status of the promoter is not a

reason for exemption from open offer.

Authors:

Anurag Shah,

Parina Muchhala and

Nishchal Joshipura

You can

direct your queries or comments to the relevant member.

Disclaimer

The contents of this hotline should

not be construed as legal opinion. View detailed disclaimer.

This hotline does not constitute a

legal opinion and may contain information generated

using various artificial intelligence (AI) tools or

assistants, including but not limited to our in-house

tool,

NaiDA. We strive to ensure the highest quality and

accuracy of our content and services. Nishith Desai

Associates is committed to the responsible use of AI

tools, maintaining client confidentiality, and adhering

to strict data protection policies to safeguard your

information.

This hotline provides general information

existing at the time of preparation. The Hotline is

intended as a news update and Nishith Desai Associates

neither assumes nor accepts any responsibility for any

loss arising to any person acting or refraining from

acting as a result of any material contained in this

Hotline. It is recommended that professional advice

be taken based on the specific facts and circumstances.

This hotline does not substitute the need to refer to

the original pronouncements.

This is not a spam email. You have

received this email because you have either requested

for it or someone must have suggested your name. Since

India has no anti-spamming law, we refer to the US directive,

which states that a email cannot be considered spam

if it contains the sender's contact information, which

this email does. In case this email doesn't concern

you, please

unsubscribe from mailing list.

|

|

We aspire

to build the next generation

of socially-conscious lawyers

who strive to make the world

a better place.

At NDA, there

is always room for the right

people! A platform for self-driven

intrapreneurs solving complex

problems through research, academics,

thought leadership and innovation,

we are a community of non-hierarchical,

non-siloed professionals doing

extraordinary work for the world’s

best clients.

We welcome

the industry’s best talent -

inspired, competent, proactive

and research minded- with credentials

in Corporate Law (in particular

M&A/PE Fund Formation),

International Tax , TMT and

cross-border dispute resolution.

Write to

happiness@nishithdesai.com

To learn more

about us

Click here.

|

|

Chambers

and Partners Asia

Pacific 2024:

Top Tier for Tax,

TMT, Employment,

Life Sciences, Dispute

Resolution, FinTech

Legal

Legal 500

Asia Pacific 2024:

Top Tier for Tax,

TMT, Labour &

Employment, Life

Sciences & Healthcare,

Dispute Resolution

Benchmark

Litigation Asia

Pacific 2024:

Top Tier for Tax,

Labour & Employment,

International Arbitration

AsiaLaw

Asia-Pacific 2024:

Top Tier for Tax,

TMT, Investment

Funds, Private Equity,

Labour and Employment,

Dispute Resolution,

Regulatory, Pharma

IFLR1000

2024: Top

Tier for M&A

and Private Equity

FT Innovative

Lawyers Asia Pacific

2019 Awards:

NDA ranked 2nd in

the Most Innovative

Law Firm category

(Asia-Pacific Headquartered)

RSG-Financial

Times:

India’s Most

Innovative Law Firm

2019, 2017, 2016,

2015, 2014

|

|

|

|